Bitcoin’s price has been pretty stable lately, bouncing around between $83,000 and $86,000. Analyst Burak Kesmeci has pointed out some important price levels to keep an eye on for short-term movements.

Support and Resistance Levels

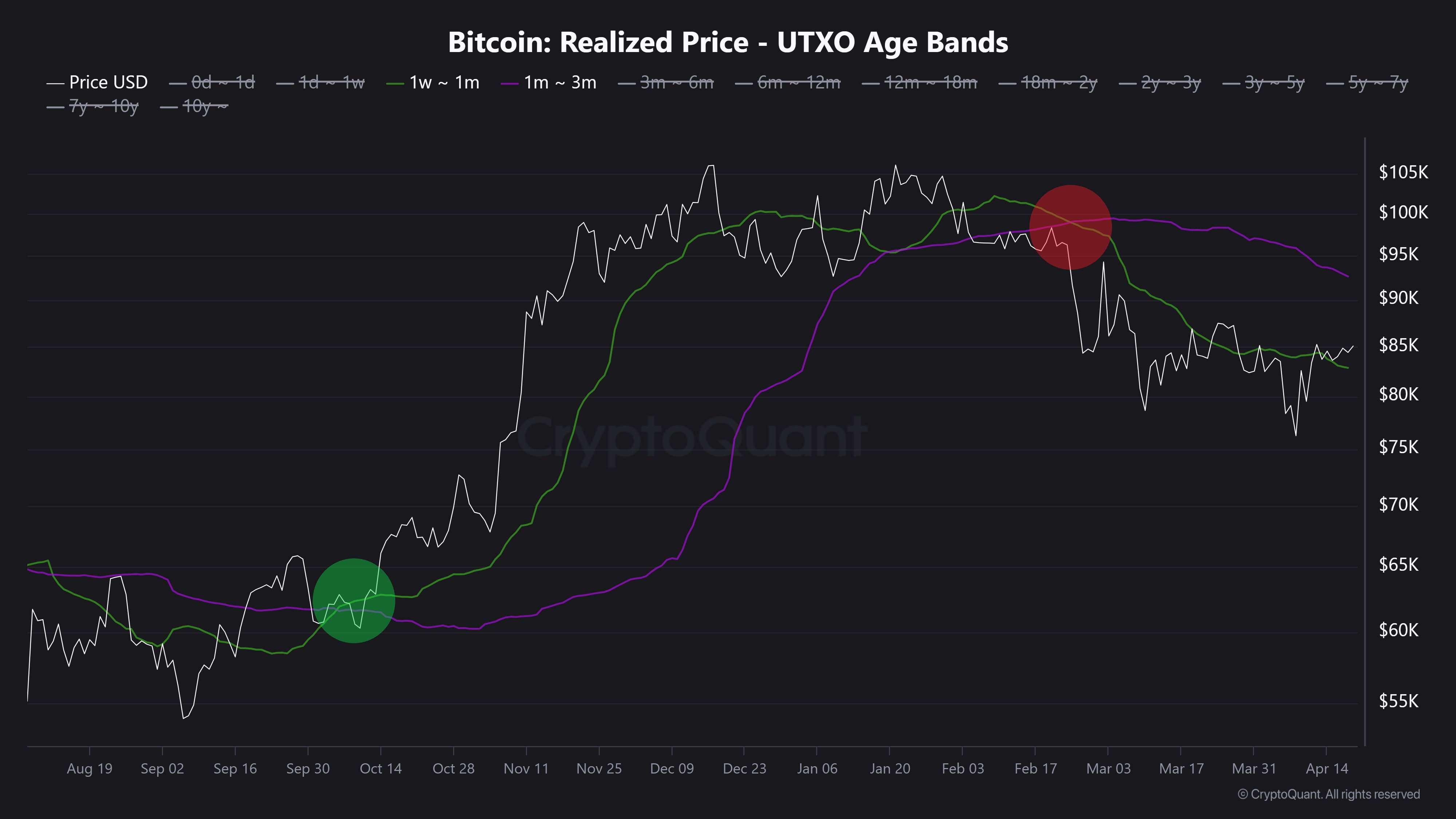

Kesmeci’s analysis, shared on X, uses the average cost basis of Bitcoin investors to identify key support and resistance levels.

-

Support at $82,800: This is the average cost for new Bitcoin buyers (those who bought in the last 1-4 weeks). Since many of these recent buyers are still in profit, they’re likely to try and hold the price above this level.

-

Resistance at $92,000: This is the average cost for investors who bought Bitcoin 1-3 months ago. Once they break even, many will likely sell, creating resistance at this price. This level also lines up with other technical indicators, making it even more significant.

The Crucial Crossover

Historically, Bitcoin sees short-term rallies when the average cost of recent buyers (1-4 weeks) surpasses the average cost of slightly longer-term holders (1-3 months). This shows growing confidence and buying pressure. However, that hasn’t happened yet.

Currently, Bitcoin is trading above the $82,800 support but below the $92,000 resistance. Both support and resistance levels have been trending down over the past two months, suggesting less aggressive buying. Kesmeci believes Bitcoin needs to break through $92,000 to signal a strong bullish trend.

Institutional Investor Sentiment: A Red Flag?

Separately, Ali Martinez reports that Bitcoin ETFs saw withdrawals of 1,725 Bitcoin (about $146.92 million) last week. This indicates negative sentiment among institutional investors and adds to the market uncertainty.

Bitcoin’s Current Status

At the time of writing, Bitcoin is trading around $85,249. That’s a slight increase (0.89%) over the past day, but down 0.58% for the week and up 1.06% for the month.