Big investors, often called “whales,” are buying Bitcoin like crazy, and it might mean a big price jump is coming.

Whales are Gobbling Up Bitcoin

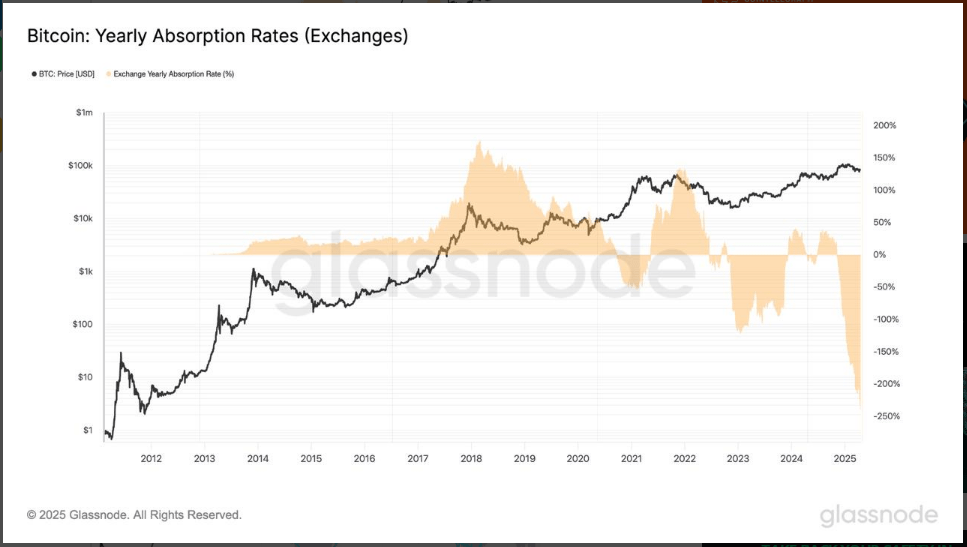

Recent data shows whales (those holding 100-1,000 BTC) are buying way more Bitcoin than miners are creating—over three times as much! At the same time, a lot of Bitcoin is leaving major exchanges. This suggests whales are moving their Bitcoin to long-term storage, showing confidence in Bitcoin’s future. They’re mostly buying during dips, seeing them as opportunities to add to their holdings. This buying pattern reminds analysts of what happened before Bitcoin’s big price run in 2020.

Technical Analysis: Resistance and Support

Bitcoin’s price is currently bumping up against some key resistance levels (around $85,500). If it can’t break through, a price drop is possible. However, there’s strong support around $80,000. The price has been stuck in a relatively tight range ($75,000-$85,000) for a while. This sideways movement, combined with heavy buying, hints at a period of accumulation before a major price swing.

The Usual Bull Market Dip?

Bitcoin’s price has corrected by about 30% since hitting highs near $100,000 a few months ago. But analysts say this is normal for a bull market. A 25-35% correction mid-cycle is often followed by another price increase.