Bitcoin’s price has been on the rise lately, climbing back above $86,000 after a recent surge. This follows a period of growth, with Bitcoin gaining over 15% since dipping to around $74,000. But is this just a temporary blip, or the start of a bigger bull run? One analyst thinks we might be seeing early signs of a recovery.

The MVRV Ratio: A Key Indicator

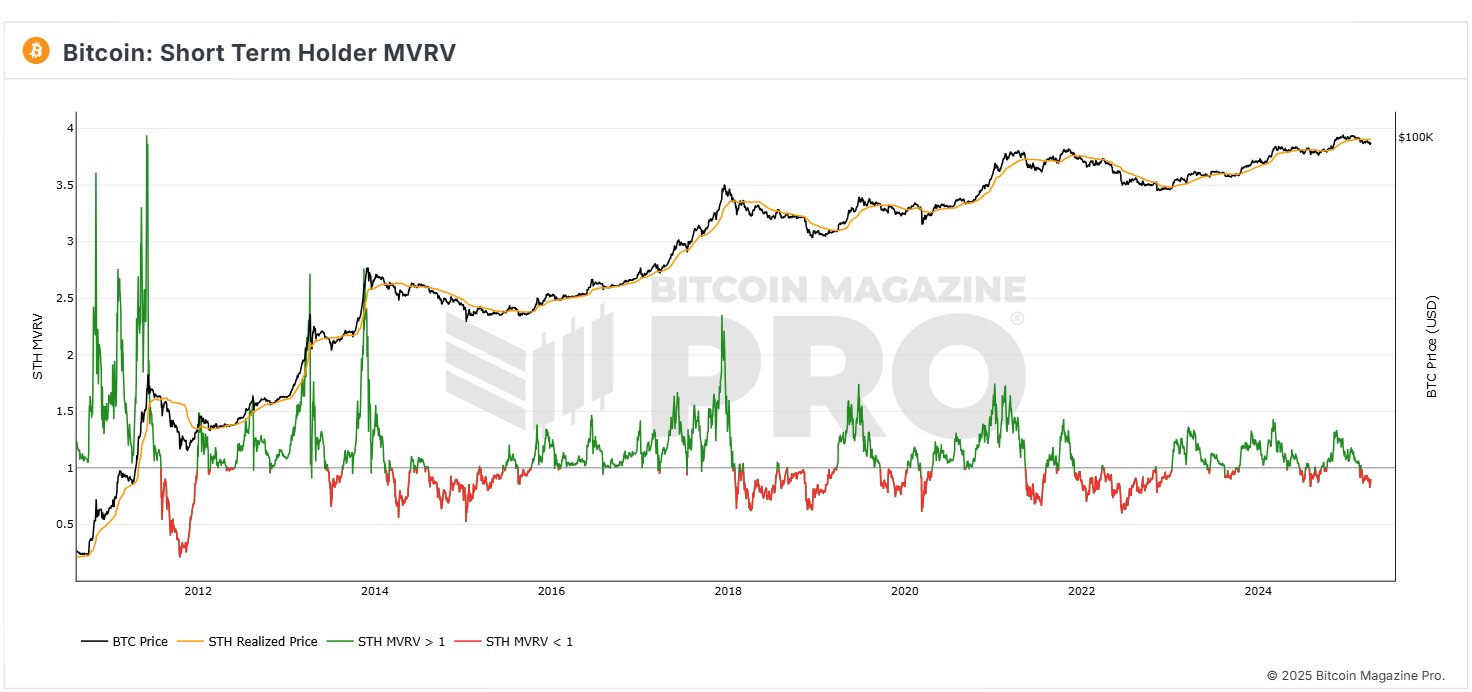

Analyst Burak Kesmeci points to the Bitcoin Short-Term Holder Market Value to Realized Value (MVRV) ratio as a crucial indicator. The MVRV basically shows whether investors are generally making money or losing money. A score below 1.00 means the average investor is in the red, while above 1.00 suggests profit.

Short-term holders (those who’ve held Bitcoin for less than 155 days) are particularly important because they tend to react more quickly to price changes. Their MVRV gives us a good idea of overall market sentiment.

The Numbers Tell a Story

Recently, the STH MVRV hit a low of 0.82 during some market turbulence. This was even lower than during a previous crisis in August 2024, when it dipped to 0.83. However, things are looking up. The STH MVRV has now climbed to 0.90, getting closer to the profit zone (above 1.00).

While this is positive, Kesmeci cautions that we need to see the MVRV cross 1.00 before we can confidently say a major price increase is on the horizon for short-term holders. Still, the move from 0.82 to 0.90 is a good sign, suggesting a shift in market sentiment.

What’s Next for Bitcoin’s Price?

Currently, Bitcoin is trading around $85,390, after a slight dip. While it’s showing weekly and monthly gains (2.11% and 4.33% respectively), daily trading volume has dropped significantly (by 38.98%). This is something to watch.

Resistance is expected around the $88,000 mark, a level that has previously held Bitcoin back. If the price falls, support is likely around $79,000. So, while the recent gains are encouraging, it’s too early to declare a full-blown bull market just yet.