Ethereum (ETH) has been having a rough time lately. It’s trading at its lowest point since late 2023, down over 57% since December 2024. The whole crypto market is feeling the pressure from economic uncertainty and volatility, and it doesn’t look like ETH’s slide is over yet.

Whale Watching: A Sign of Hope?

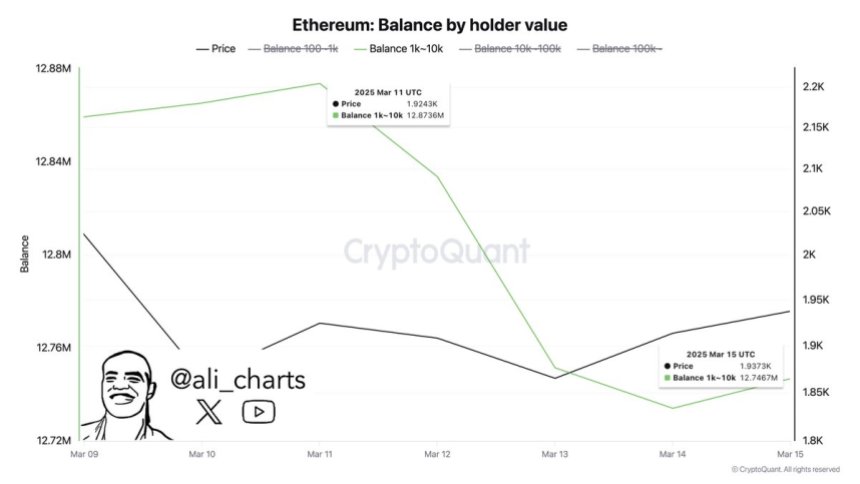

But here’s a glimmer of good news: Big investors, or “whales,” are quietly accumulating ETH. Data shows over 130,000 ETH moved off exchanges recently. This suggests they’re buying the dip and planning to hold onto their ETH for the long term. This kind of activity often happens before a price rebound.

What the Whales Are Doing

Why is this important? When whales move their ETH to private wallets, it usually means they’re not planning to sell anytime soon. Historically, this accumulation has been a good indicator that a price increase might be on the horizon. Less ETH on exchanges can lead to more price stability and potential growth.

The Price Battle: $2000 and Beyond

Right now, ETH is struggling to break above $2000. This is a key resistance level. If bulls (those betting on price increases) can push ETH above $2000 and hold it there, it could signal a rally towards $2250-$2400.

However, if the price drops below $1750, it could trigger more selling and a much longer downturn. The next major support level is around $1600.

The Bottom Line

While the overall market is still uncertain, the whale activity is interesting. It suggests some smart money is betting on ETH’s future. The next few weeks will be crucial to see if ETH can break its downward trend or if the price will continue to fall. The macro-economic climate and overall market sentiment will play a big role in what happens next.