Bitcoin’s price has been a rollercoaster lately.

Recent Price Drop and Market Concerns

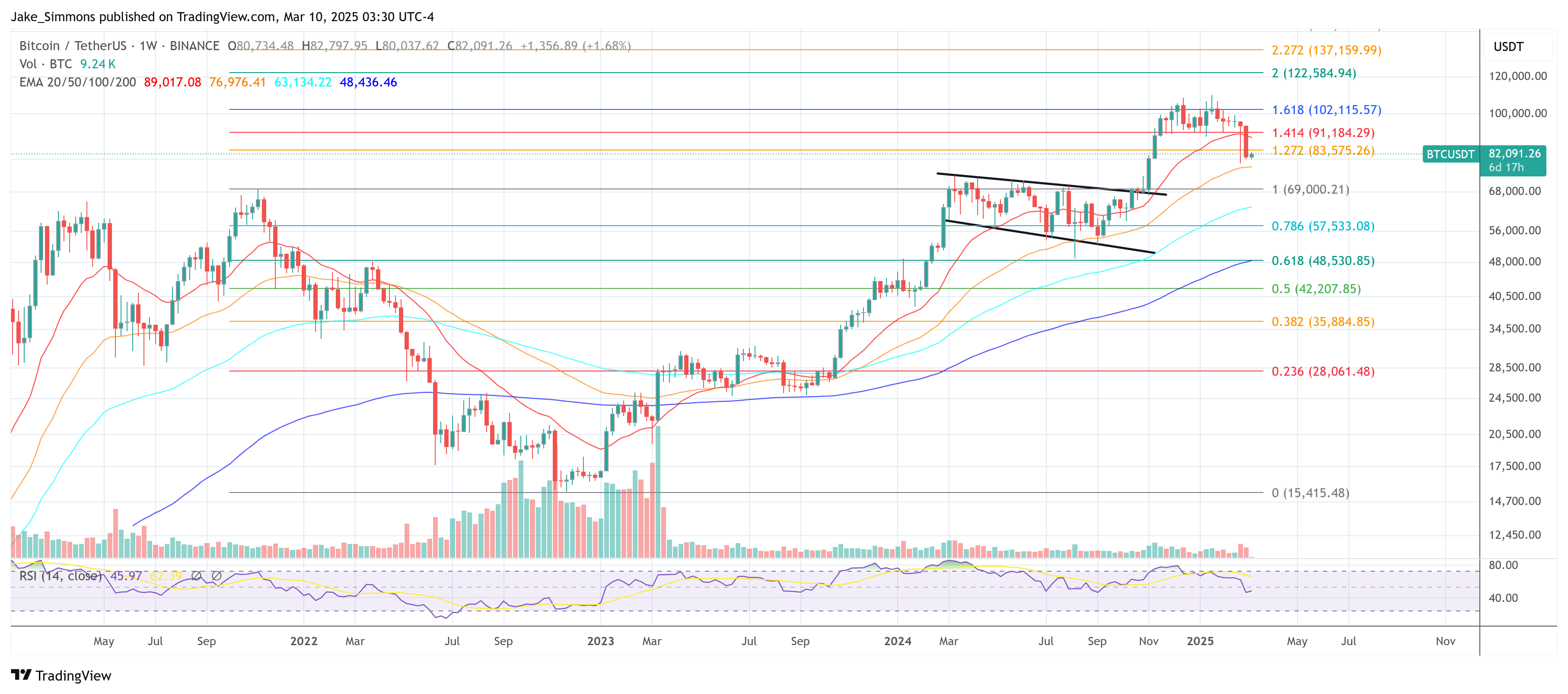

Over the weekend, Bitcoin dropped 5%, briefly dipping below $80,000 before recovering slightly to around $82,000. This is about 25% down from its all-time high. Analysts blame trade tensions and recession fears for the downturn.

The Weakening Dollar and Bitcoin’s Potential

Interestingly, the US Dollar Index (DXY) has been falling—from 110 to 103 since mid-January—which could actually be good news for Bitcoin.

A Crypto Analyst’s Perspective

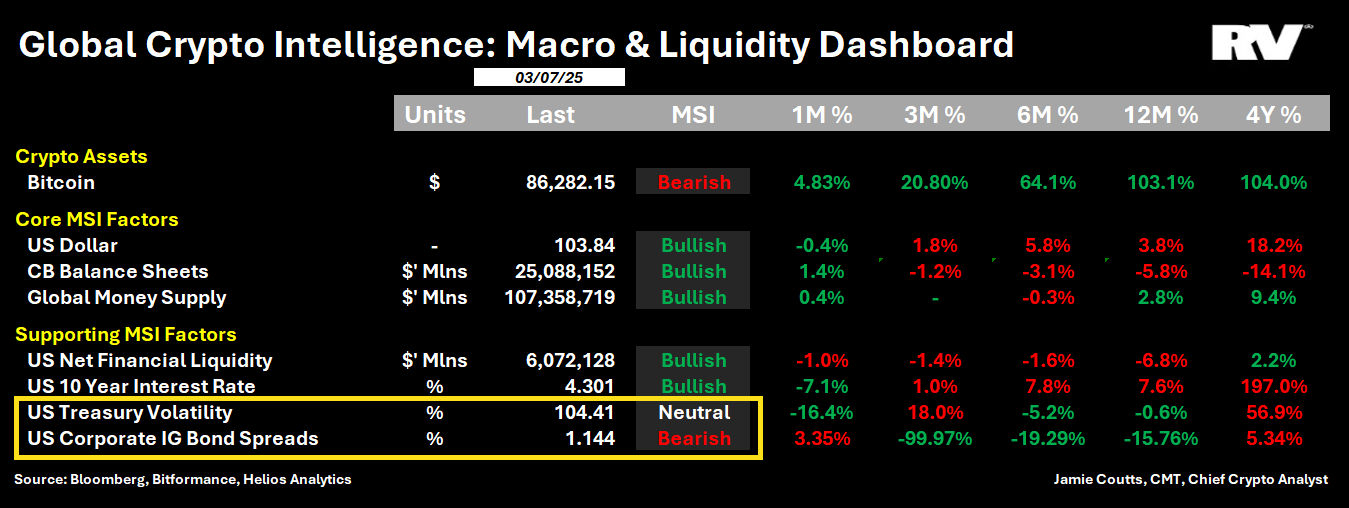

Jamie Coutts, a leading crypto analyst, sees Bitcoin in a tense standoff with central banks. He points to two key factors:

-

Treasury Bond Volatility: High volatility in Treasury bonds (measured by the MOVE Index) is causing problems. When volatility rises, lenders get nervous and tighten lending, reducing liquidity. Coutts thinks that if the MOVE Index goes above 110, central banks will start to worry.

-

Widening Corporate Bond Spreads: This indicates that the demand for riskier assets (including Bitcoin) is falling, potentially putting downward pressure on Bitcoin’s price.

Reasons for Optimism (Despite the Risks)

Despite these concerns, Coutts remains optimistic about Bitcoin’s long-term prospects, mainly because of the falling dollar. Historically, significant dollar drops have coincided with Bitcoin price increases.

He also cites several potential catalysts that could boost Bitcoin’s price:

- Nation-State Adoption: Countries might add Bitcoin to their reserves or increase Bitcoin mining.

- Corporate Accumulation: Companies like MicroStrategy could buy a lot more Bitcoin.

- ETF Growth: Bitcoin exchange-traded funds could see a significant increase in holdings.

- Increased Liquidity: Coutts believes Bitcoin’s liquidity will increase.

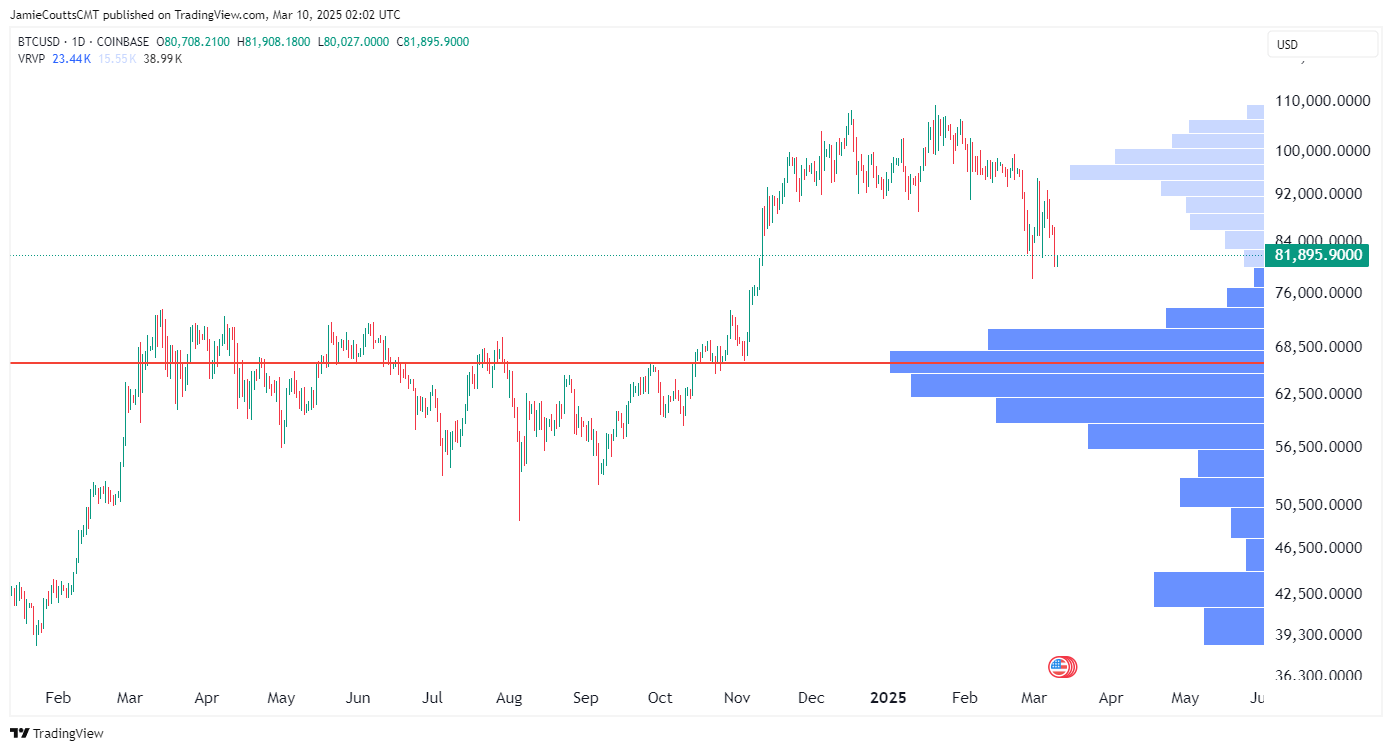

Coutts also noted that Bitcoin seems to be filling a price gap, and a drop below the high-$70,000 range would signal a major market shift. He anticipates central banks might intervene if bond market problems worsen, further impacting asset prices.

The Showdown

Coutts summarizes the situation as a high-stakes game of chicken between Bitcoin and central banks. If Bitcoin holders hold firm (and aren’t heavily leveraged), the odds might be in their favor.

The Bottom Line

Bitcoin’s future is uncertain. It’s caught between a weakening dollar (good) and a volatile bond market (bad). The outcome will likely depend on how central banks react and whether Bitcoin holders are willing to ride out the storm. At the time of writing, Bitcoin was trading at $82,091.