Ethereum’s price has been making some interesting moves, and analysts are weighing in on what it all means. Let’s dive into some key technical indicators and see what the experts are saying about ETH’s trajectory in 2024 and beyond.

2024 vs. 2025: A Technical Analysis

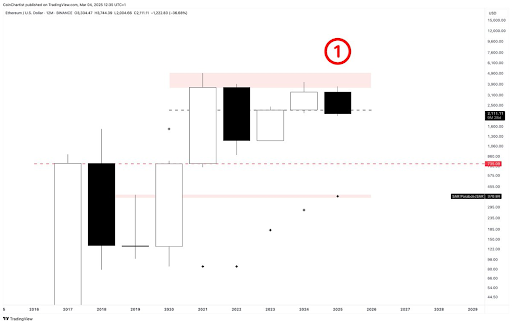

Analyst Tony Severino compared Ethereum’s price action in 2024 to its current performance, using candlestick charts, TD Sequential, and Parabolic SAR indicators. His analysis paints a somewhat bearish picture.

- Candlestick patterns: Severino pointed out that the 2024 candlestick showed a lower high, while the 2025 candlestick is currently a bearish engulfing pattern – meaning the current candle’s body completely covers the 2024 candle’s body. This is a potentially negative sign.

- Support and Resistance: He identified yearly support around $735 and a Parabolic SAR indicator at $370. The TD Sequential indicator is showing a “red 1,” which

could signal the start of a yearly downtrend. However, he cautions that it’s still early to make definitive conclusions, as the year is far from over.

could signal the start of a yearly downtrend. However, he cautions that it’s still early to make definitive conclusions, as the year is far from over.

Ethereum’s recent dip below $2000 (for the first time since December 2023) also adds to the bearish sentiment. The fact that January and February both saw negative monthly closes – a first for ETH – is another concerning factor. Analyst Ali Martinez even suggested a potential drop to as low as $1600 or even $1200.

A Potential Reversal?

Not everyone is bearish. Analyst Titan of Crypto believes Ethereum has already bottomed out. He highlights that the 2024 low has been “swept” on the perpetual daily chart, indicating a potential reversal point. His analysis suggests a possible return to all-time highs.

He also points to two unfilled gaps in ETH CME futures contracts above $2500. These gaps often get filled, suggesting a possible short-term price rebound towards $2540-$2620 or even $2900-$3300.

Current Status and Conclusion

At the time of writing, Ethereum is trading around $2176, up slightly in the last 24 hours. While short-term rebounds are possible, the conflicting signals from different analysts highlight the uncertainty surrounding Ethereum’s future price movement. Whether it’s a temporary dip or the start of a longer downtrend remains to be seen. The situation warrants careful monitoring and further analysis.