Bitcoin took a surprise dive recently, dropping below $90,000 and dragging other cryptos down with it. This left many bullish investors feeling the pinch. But is this a disaster, or something else entirely?

A Necessary Correction?

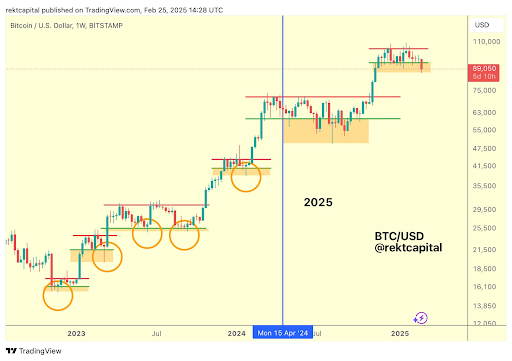

Bitcoin hadn’t traded below $90,000 since November 2024. After a long climb, it had been consolidating between $90,000 and $100,000 for weeks. While nerve-wracking for some, analysts saw this as a normal part of Bitcoin’s cycle.

Crypto analyst Rekt Capital points out that Bitcoin often goes through “re-accumulation” phases during bull runs. This is essentially a market reset before the next big price jump. The recent drop below $90,000 fits this pattern, described as a “downside deviation” – something Bitcoin has done before.

What’s Next for Bitcoin?

During re-accumulation, big investors (whales) and some smaller players are buying, while others are selling. Data shows that some long-term Bitcoin holders are actually increasing their holdings, adding 20,400 BTC in just 48 hours. They see this as a great buying opportunity.

Bitcoin’s future depends on how it behaves around this $90,000 level.

-

A Reclaim of $90,000:

This would signal the dip was just a temporary shakeout, leading to further price increases and potentially a push past $100,000.

This would signal the dip was just a temporary shakeout, leading to further price increases and potentially a push past $100,000. -

A Continued Decline: Falling further below $90,000 could be serious, especially for those who bought recently. There isn’t much support until around $70,000.

At the moment, Bitcoin is trading around $88,628 (down 7.5% in a week), but it has shown signs of stabilizing, recovering slightly after hitting a low of $86,867. So, the situation is still developing.