A crypto analyst is predicting further gains for the cryptocurrency market. Jamie Coutts, Real Vision’s chief digital assets analyst, believes a key indicator points to a long way to go before the current bull run ends.

Global Liquidity and Crypto’s Future

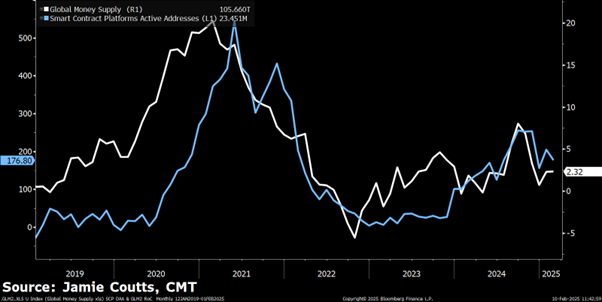

Coutts shared his analysis on X (formerly Twitter), highlighting the relationship between global money supply (M2) and cryptocurrency activity. He argues that the historical correlation suggests more price increases are likely. He explains that high global liquidity, coupled with increasing cryptocurrency adoption (measured by active addresses on blockchains), paints a bullish picture. His analysis shows that these factors are aligned, indicating significant further growth potential.

A Bullish Signal from Global Liquidity

Coutts shared a chart demonstrating the parallel trends between active crypto addresses and M2. He noted that global liquidity is on an upward trajectory and could soon surpass last year’s peak. He also pointed to a weaker US dollar as a driver of this bullish momentum, suggesting that central bank intervention may be on the horizon. He’s looking for a break above mid-2024 highs to confirm a new, higher price regime.

Government Bitcoin Accumulation on the Rise

Coutts also predicted increased Bitcoin acquisition by governments. He cited the example of a major sovereign wealth fund accumulating Bitcoin, and suggested that many developing nations with domestic Bitcoin mining operations have likely been quietly accumulating the asset for over a year, a trend he expects to accelerate.