A leading crypto analyst believes the crypto market might be nearing its bottom after a prolonged downturn. This positive outlook is based on several key indicators.

Signs of a Market Reversal

Jamie Coutts, Real Vision’s chief digital assets analyst, points to a metric tracking crypto performance over the past year. This metric shows the highest reading since mid-2024, suggesting a potential bottom is forming. He advises focusing on assets that performed well over the past year, even during recent dips, as these might lead the next market upswing. Coutts also highlights the TOTAL2 chart (market cap excluding Bitcoin and stablecoins), which shows a possible reversal after a period of decline. TOTAL2 is currently valued at $1.24 trillion.

Bitcoin’s Changing Role?

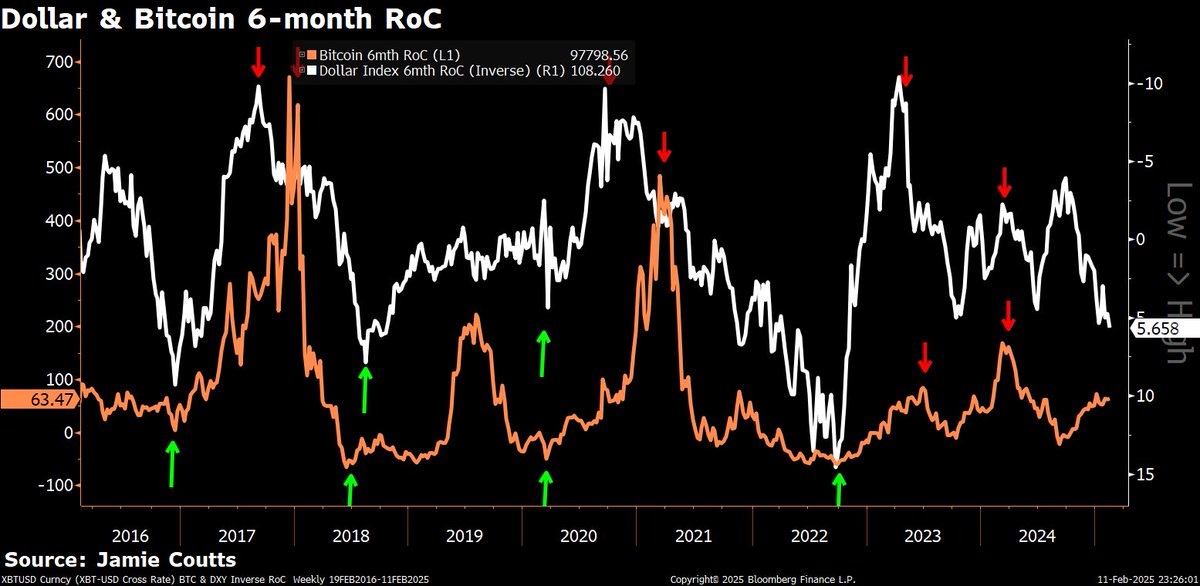

Coutts suggests Bitcoin might be breaking its usual inverse correlation with the US dollar index (DXY). This could mean Bitcoin is increasingly seen as a safe haven asset, similar to gold. He notes Bitcoin’s price rise alongside a DXY increase, questioning whether this shift is due to ETFs, MicroStrategy’s investments, or other factors.

Blockchain Adoption Soars

Despite market volatility, Coutts observes a surge in blockchain adoption. Daily active addresses on smart contract platforms have tripled in the past year, showing resilience even when market liquidity is uncertain. He emphasizes that blockchain technology is experiencing rapid growth, regardless of short-term market fluctuations.

Looking Ahead to 2025

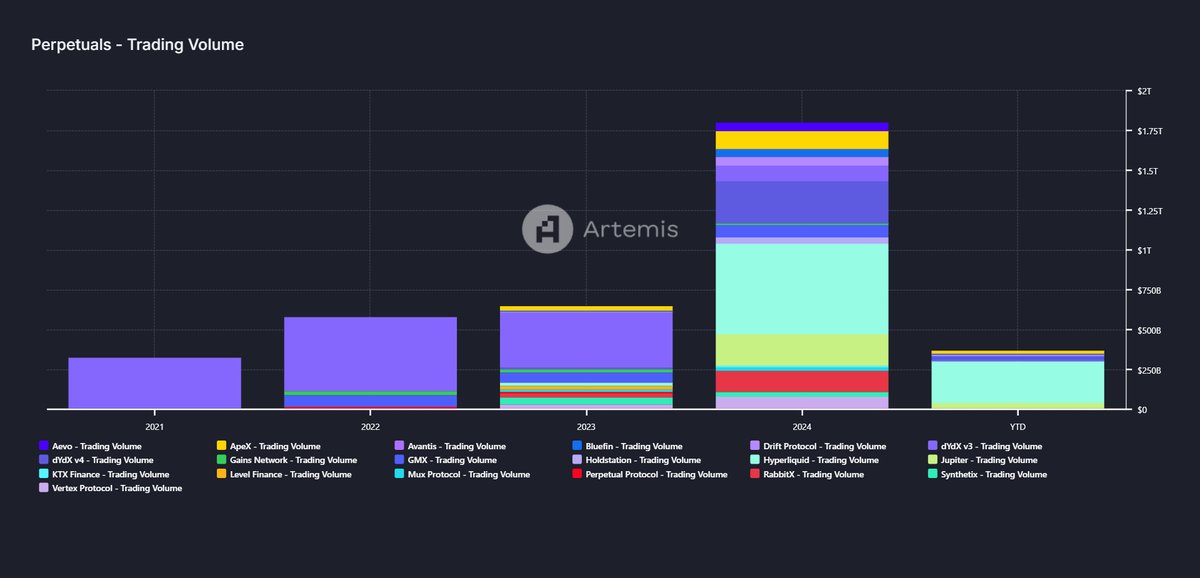

Coutts predicts a massive increase in blockchain adoption across various sectors in 2025, forecasting on-chain derivatives volume exceeding $4 trillion. He anticipates the integration of real-world assets (RWAs) like stocks, commodities, and bonds, further driving growth.

Disclaimer: This information is for general knowledge and shouldn’t be considered investment advice. Always do your own research before investing in cryptocurrencies./p>