Ethereum’s price has been a bit of a rollercoaster lately. It ended 2024 below $3,500 and didn’t exactly take off in the first month of 2025. This has some investors worried, wondering if it’s time to bail.

A Crypto Analyst Weighs In

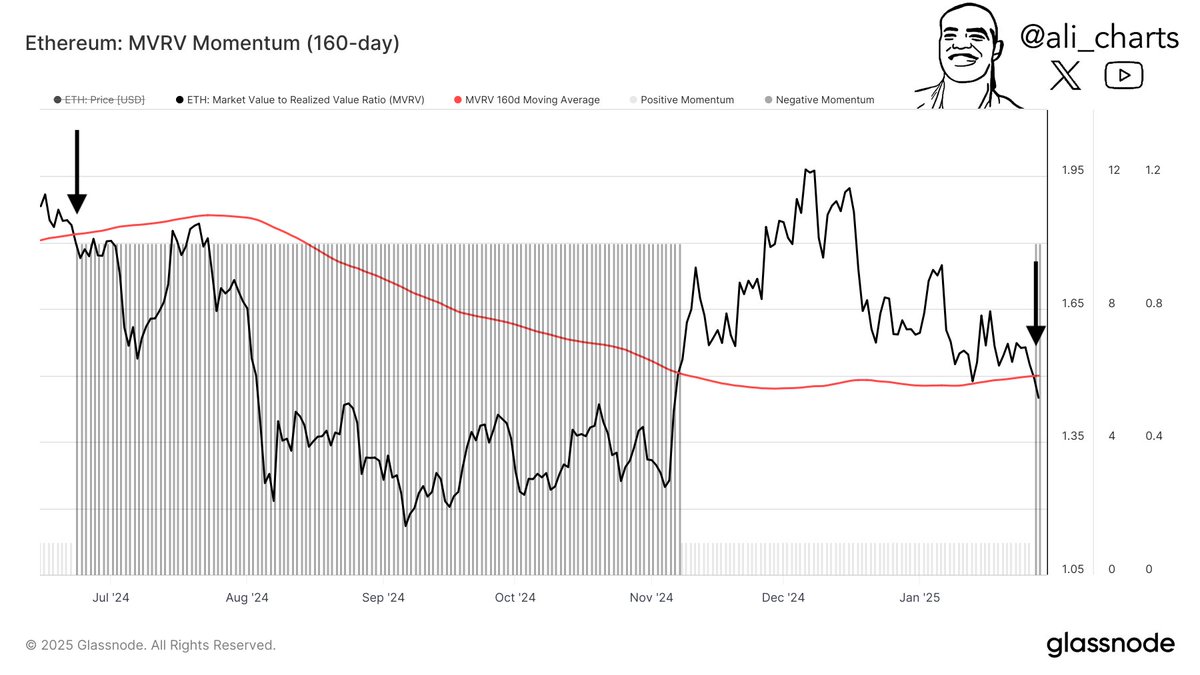

Crypto analyst Ali Martinez recently shared his thoughts on X (formerly Twitter). He looked at Ethereum’s price history and some key on-chain data to predict what might happen next.

A Potential Price Drop?

Martinez sees a possible short-term correction. He’s using the MVRV Ratio (a 160-day moving average) which helps gauge if a coin is overvalued. When Ethereum’s price fell below this MVRV, a 40% drop followed last time. Adding to the concern, long-term holders are starting to sell, increasing the chances of a price correction.

Key Support Levels

If a correction does happen, some price levels are crucial. The $2,230 to $2,610 range is a significant support zone; a lot of ETH was bought around those prices. Technically, the price looks like it might be forming an inverse head-and-shoulders pattern, with support between $2,800 and $3,000.

A Bullish Scenario?

If that support holds, Martinez thinks Ethereum could hit $4,000 (the neckline of the pattern). While $4,000 has been a resistance level for years, recent whale activity (they bought over $340 million worth of ETH recently) makes a breakout more likely. If it breaks through $4,000, Martinez suggests it could soar to as high as $6,770, based on MVRV bands.

Current Price and Conclusion

At the time of writing, Ethereum is around $3,315, up slightly in the last 24 hours. The future remains uncertain, but Martinez’s analysis gives us a range of possibilities, from a significant correction to a massive price surge.