Ethereum (ETH) has bounced back impressively after the recent Federal Open Market Committee (FOMC) announcement, surging by 5.35%. Historically, ETH often recovers quickly from volatility, sometimes seeing gains as high as 34%! This recovery is fueled by increasing institutional interest, with a net inflow of $67.77 million into ETH ETFs, led by BlackRock. Let’s dive into the details.

Ethereum’s Post-FOMC Recovery

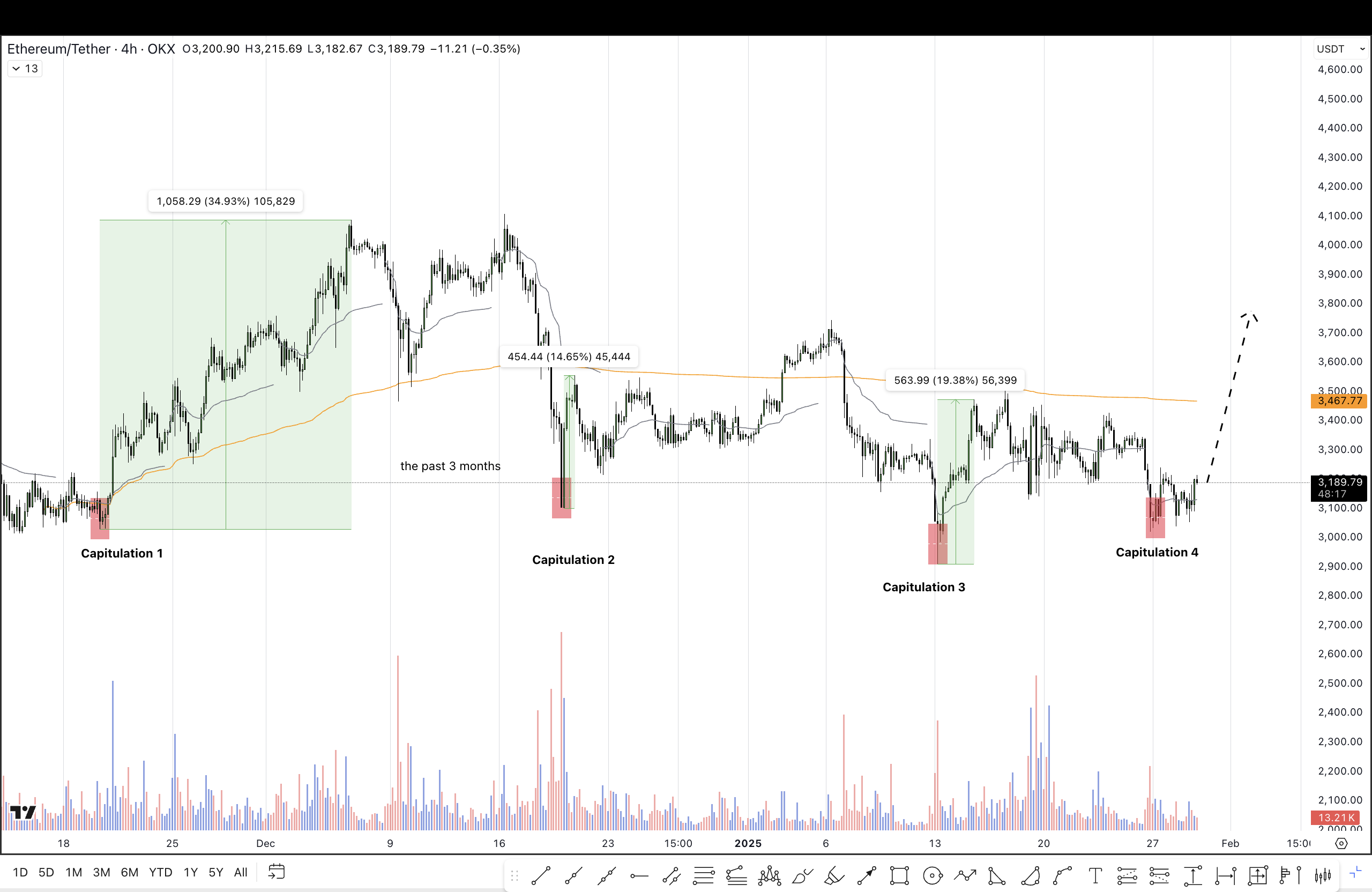

Over the past few months, Ethereum has shown a consistent recovery pattern after periods of market volatility triggered by FOMC announcements. Data shows ETH frequently experiences significant price increases during these volatile times. Specifically, it tends to respond to sudden dips with rapid rebounds, ranging from modest increases to impressive jumps of up to 34%. This pattern becomes clearer when you overlay Ethereum’s price fluctuations with capitulation data on the chart. The recent 5.35% increase since the last FOMC announcement suggests a continued positive trend, potentially pushing ETH towards $3800 despite global economic uncertainty.

Institutional Investors Pile into Ethereum

Institutional demand for Ethereum is surging. On January 30th, the total daily net inflow for Ethereum ETFs reached $67.77 million. BlackRock was the biggest buyer, acquiring $79.86 million worth of ETH. Fidelity and Grayscale also made significant purchases, at $15.41 million and $12.79 million respectively. The only seller that day was the Grayscale mini-Ethereum trust, which released $40.29 million.

ETH’s Bullish Breakout

The 4-hour ETH price chart shows a bullish reversal with a “double bottom” pattern. As predicted, the reversal rally has surpassed the 23.6% Fibonacci level at $3248. The recovery rally also pushed the upper Bollinger Band, reflecting a 1.12% increase in the past 4 hours. With the rally continuing, the Bollinger Bands suggest a potential breakout.

Ethereum Price Prediction

Intotheblock’s In/Out of the Money chart shows ETH approaching a key resistance zone between $3264 and $3342. This zone holds 6.26 million ETH, making it a high-supply area. The “at the money” zone currently holds 7.85 million ETH between $3109 and $3264, highlighting a significant level. On the daily chart, Fibonacci levels pinpoint crucial targets at the 50% and 100% retracement levels, at $3509 and $4079 respectively. On the downside, the $3000 support zone is expected to hold strong in the first quarter of 2025.

Beyond Ethereum: Exploring Other Opportunities

While ETH is doing well as the second-largest cryptocurrency, you might consider exploring other promising cryptocurrencies with lower market caps for potentially higher returns. One example is Mind of Pepe (MIND), which combines AI innovation with meme coin appeal, acting as an autonomous AI agent in crypto. It analyzes altcoin trends and offers exclusive insights to MIND holders. Its presale has already raised $4.6 million and offers staking with a 490% APY. Visit the official MIND of Pepe website for more information.