Ethereum’s price might be in for a rough ride, according to some on-chain data. Let’s break down what’s happening.

The MVRV Ratio: What Does it Mean?

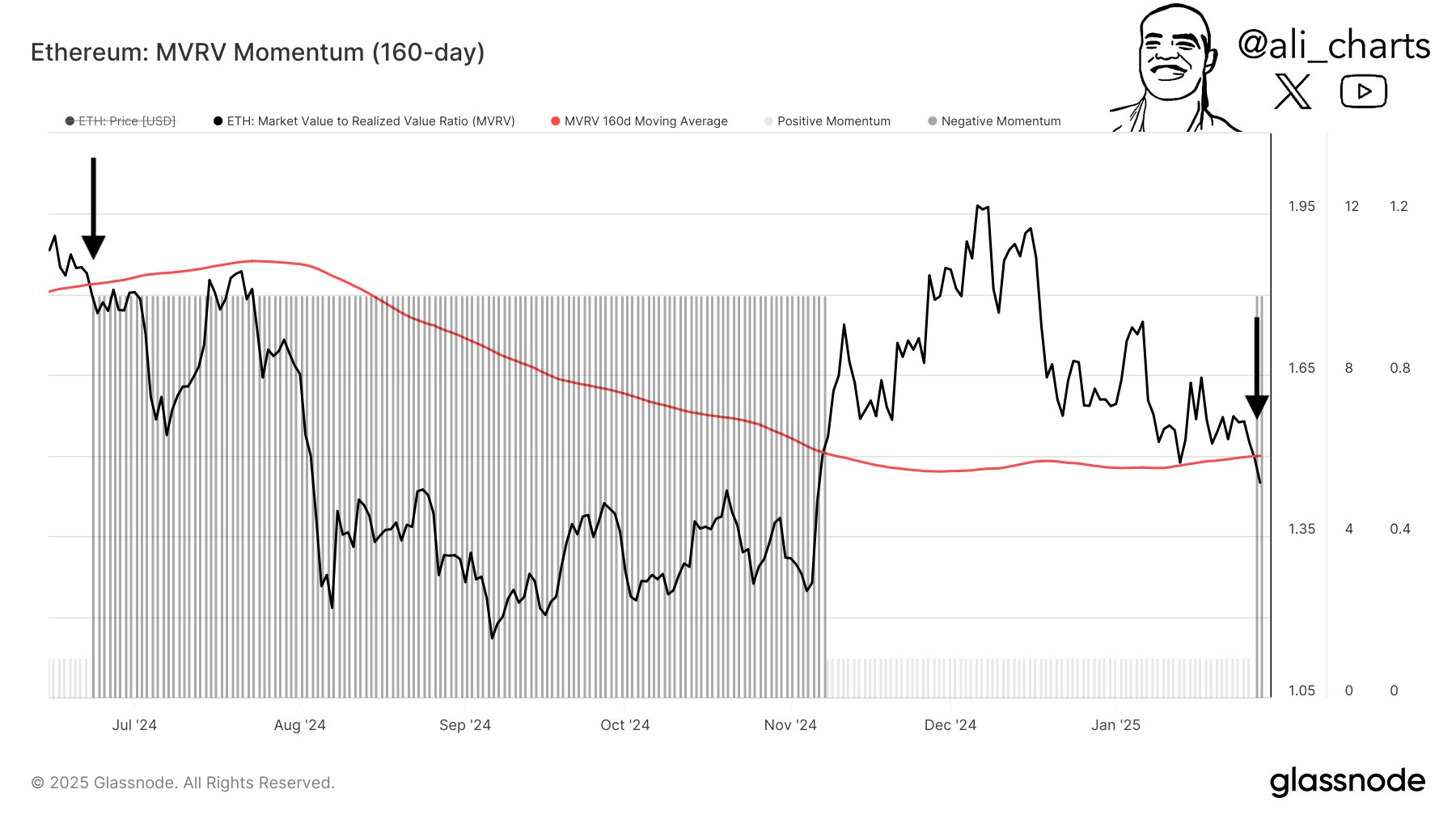

The Market Value to Realized Value (MVRV) ratio is a key indicator used to gauge the overall health of the Ethereum market. It compares the current market cap (total value of all ETH) to the realized cap.

The realized cap is a more nuanced measure. It calculates the total value of ETH based on the price each coin was last bought at. This essentially represents the total amount of money investors have actually put into Ethereum.

- MVRV > 1: Investors are generally sitting on profits (unrealized gains).

- MVRV < 1: Investors are, on average, underwater (holding ETH worth less than what they paid).

A Bearish Crossover

Recently, the Ethereum MVRV ratio dipped below its 160-day moving average. This “bearish crossover” in the MVRV momentum

A chart showing this crossover and the historical price action would be helpful here. (Imagine a chart showing the MVRV ratio and its 160-day moving average, with the recent crossover clearly marked. The chart would also show a significant price drop following a similar crossover in the past.)

Last year, a similar crossover preceded a 40% price correction for Ethereum. This historical precedent is fueling concerns that a similar drop might happen again.

What’s Next for ETH?

While the MVRV ratio is below its 160-day moving average, it’s still above 1, meaning the overall market is still in the green. However, the historical precedent is concerning.

Currently, Ethereum is trading around $3,200, up slightly over the past week. Whether this bearish signal translates into another significant price drop remains to be seen. It’s definitely something to keep an eye on.