Bitcoin (BTC) had a rough start to the week, dipping below $100,000 on Monday. But don’t worry, it quickly bounced back! This recovery has some crypto analysts predicting a big price jump in February.

A Rocky January, a Roaring February?

Monday’s market dip was part of a broader sell-off, triggered by news about artificial intelligence. Bitcoin dropped, along with other cryptocurrencies like Ethereum (ETH) and Solana (SOL). However, BTC swiftly recovered, regaining its footing above $100,000. While it hasn’t quite broken through the $103,000 mark, it’s trading steadily in the $102,000-$102,990 range.

Historical Trends Point to a February Surge

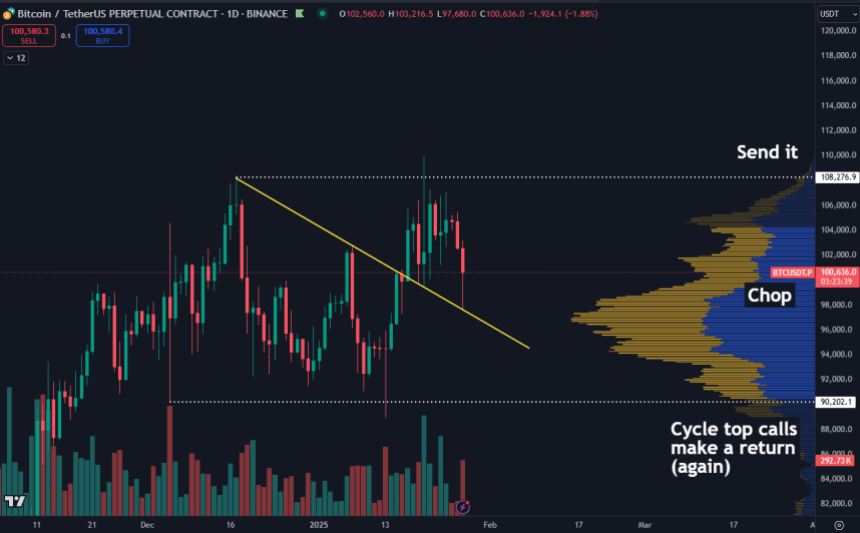

Trader Daan Crypto points out that Bitcoin’s price is staying within its typical post-election trading range. He believes that as long as it stays between $90,000 and $108,000, we can expect more of the same – decent but choppy trading. However, he, and other analysts, see something special brewing for February.

Historically, February has been fantastic for Bitcoin. Data shows that over the past 12 years, Bitcoin has seen positive growth in February 10 times, with returns as high as 61%! This is particularly true in the years following a “halving” event (a significant Bitcoin event that reduces the rate of new Bitcoin creation). In post-halving Februarys, Bitcoin has seen double-digit gains: 61% in 2013, 23% in 2017, and 36% in 2021. Eight out of the last twelve Februarys have delivered double-digit returns.

The Next Big Bitcoin Move?

Analyst Rekt Capital believes Bitcoin is poised for another significant price increase. They explain that Bitcoin has completed its initial post-halving price increase and subsequent correction. This suggests that a second, even bigger, price surge is on the horizon. Based on past cycles, Rekt Capital expects this new upward trend to begin within the next two weeks, potentially leading to new all-time highs.

The analyst’s prediction is based on Bitcoin’s performance in previous cycles. In both 2017 and 2021, significant price increases happened around week 16 of a specific phase in the Bitcoin cycle. We’re currently in week 14.

Rekt Capital advises investors to “patiently HODL” (hold onto their Bitcoin) for the next two weeks. The analyst believes that confirmation of this next upward trend will start next month. Furthermore, Monday’s closing price above $101,200 created a positive signal, potentially leading to further consolidation and a price rise to as high as $106,200.