Bitcoin’s price hovering around $100,000 has everyone talking. While retail investors are piling in, experts are warning of a potential drop.

Retail Investors Go Wild for Bitcoin

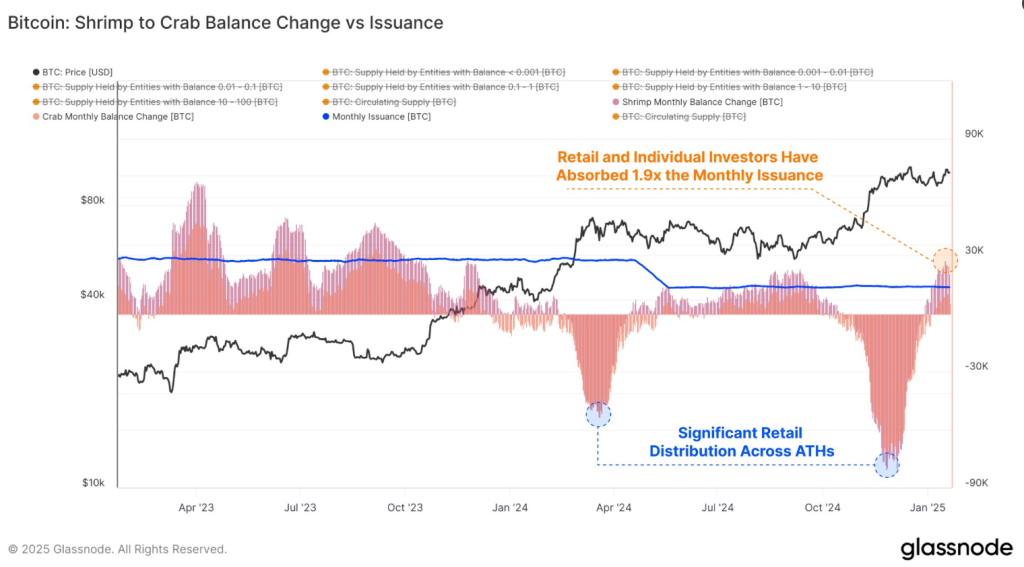

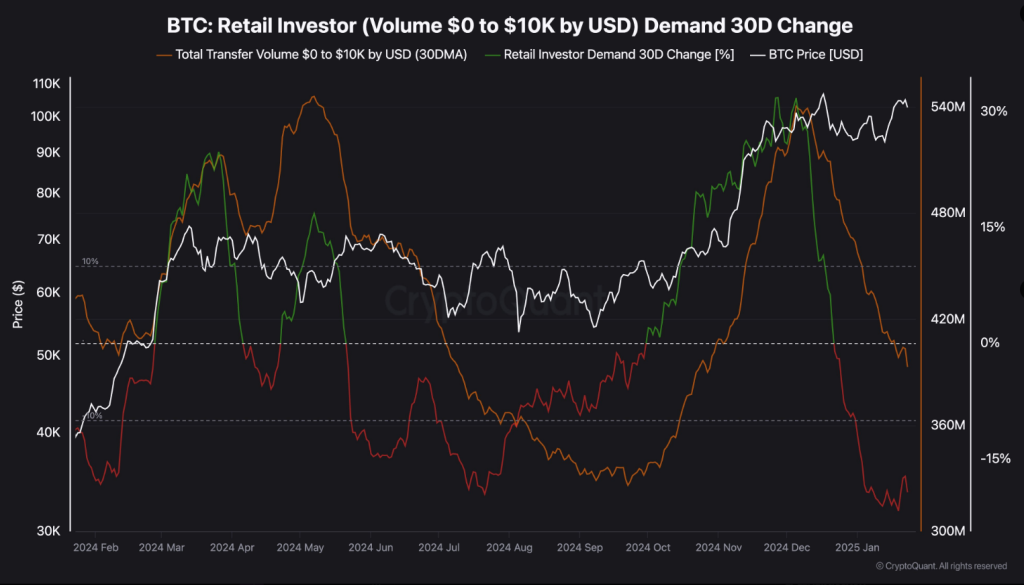

Small-time Bitcoin investors (“Shrimps” and “Crabs”) are buying up Bitcoin like crazy. Data shows they bought almost twice as much Bitcoin last month as was newly mined! This huge demand at the $100,000 price point is pretty impressive.

But…Short-Term Holders are a Worry

The problem? Many of these buyers are short-term holders (STHs). STHs are known for selling quickly when the market dips, to lock in their profits. This could lead to a big sell-off if things get rocky. Market analysts are highlighting this as a major risk factor. Their quick reactions to market changes could cause a significant price drop.

A Tight Price Range: A Warning Sign?

Another red flag: Bitcoin’s price has been stuck in a narrow range for the past two months. Historically, this kind of thing often precedes a big price swing – either up or down.

Could Bitcoin Dip to $95,000?

Putting it all together, some experts think a price correction is likely. One analyst predicts a drop to $95,000, mainly because of those jittery short-term holders.

What’s Next for Bitcoin?

While retail demand is strong right now, the market is definitely feeling a bit volatile. It’s a balancing act between enthusiastic buyers and the potential for a quick sell-off by short-term holders. Keep an eye on the market for clues about what’s next! At the time of writing, Bitcoin was trading at $105,141.