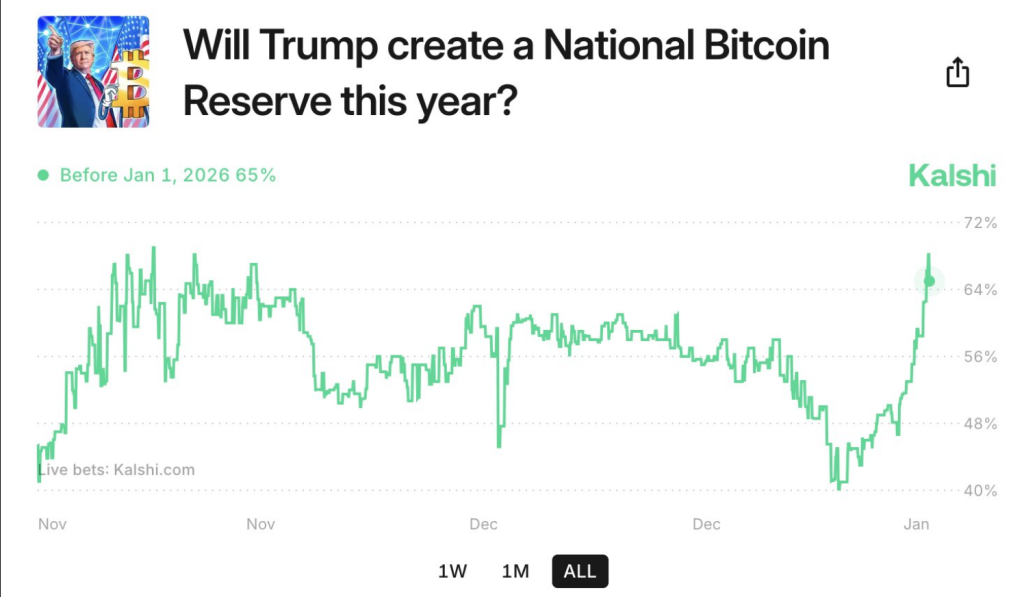

There’s a growing chance the US might create a Strategic Bitcoin Reserve (SBR) this year – a whopping 65%, according to prediction markets! This surge in probability is largely due to President-elect Trump’s pro-crypto stance and the proposed Bitcoin Act.

Trump’s Crypto Vision Fuels the Hype

A key driver behind this increased likelihood is President-elect Trump’s apparent support for cryptocurrencies. The Bitcoin Act, a central part of this, aims to build a reserve of 1 million Bitcoin units over five years. Supporters say this will boost innovation and economic resilience. Trump’s embrace of blockchain technology has given crypto enthusiasts a lot of hope, seeing his presidency as a chance to integrate digital assets into national strategies. The odds have actually doubled in just a few weeks!

Lobbying Efforts Intensify

Instead of waiting for the slow legislative process, cryptocurrency advocates are pushing for the new administration to issue an executive order. They believe an SBR would not only improve economic stability but also show global leadership in digital currencies. A presidential order could bypass bureaucratic red tape and speed things up.

Why a Bitcoin Reserve? Strategic and Financial Reasons

The push for an SBR is driven by both strategic and financial considerations. Bitcoin supporters highlight its potential as a hedge against traditional financial instability. Plus, the US risks falling behind other countries already incorporating crypto into their national policies. Creating a Bitcoin reserve is seen as a way to keep up with international competitors and secure the nation’s future.

A Pivotal Year for Crypto Policy

2025 is a crucial year for US crypto policy. The success of the Bitcoin Act and similar initiatives hinges on embracing innovation. The possibility of a US SBR is higher than ever. Whether it happens through legislation or executive action, this move could solidify Bitcoin’s role in the US economy and shape the nation’s future strategy.