Bitcoin exchange-traded funds (ETFs) are having a moment. After a slow start to the year, interest has exploded.

A Big Jump in Bitcoin ETF Inflows

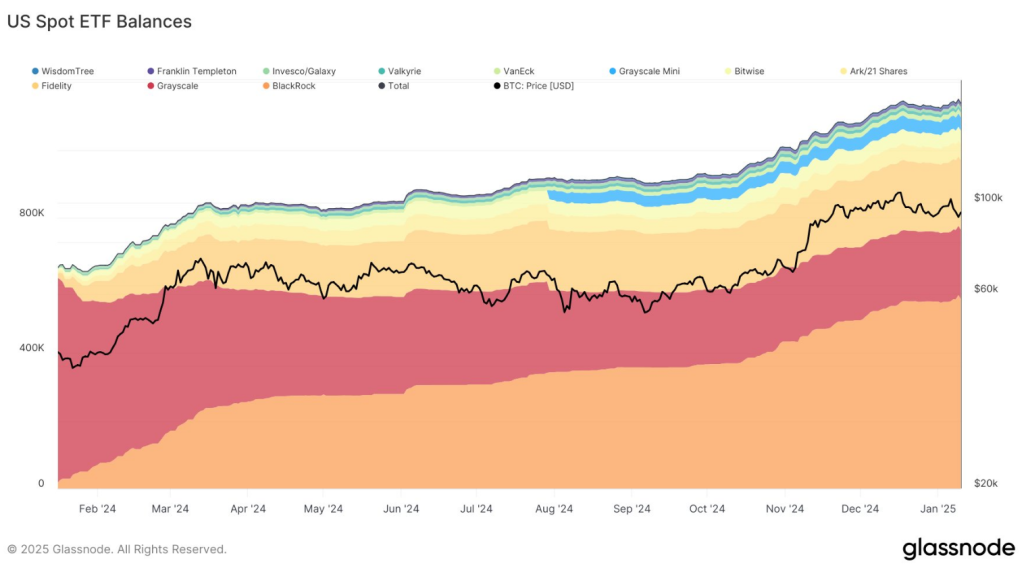

Data from Glassnode shows a huge surge in Bitcoin ETF inflows. The week ending January 6th saw a massive 17,567 BTC (about $1.7 billion) flowing into these funds. That’s more than the average weekly inflow of 15,900 BTC seen during the last quarter of 2024. This shows investors are really getting back into Bitcoin.

A Rocky Road to Recovery

The road to this point wasn’t smooth. Late 2024 saw some wild swings. A drop in Bitcoin’s price below $64,000 in September led to people pulling their money out. But things turned around in October, with inflows spiking to over 24,000 BTC in some weeks. The increase continued through November and December, showing strong and consistent demand.

Who’s Holding All the Bitcoin?

As of early January 2025, US spot Bitcoin ETFs hold around 1.13 million BTC. BlackRock is the biggest player, holding a whopping 559,673 BTC. Grayscale and Fidelity are also major holders, with over 200,000 BTC each. BlackRock’s IBIT ETF had a phenomenal first year in 2024, accumulating $37.25 billion in assets.

What Does the Future Hold?

2025 looks promising for Bitcoin ETFs. Experts predict a wave of new and innovative offerings, possibly as many as 50 new ETFs this year alone! These will cover various strategies, like covered call ETFs and Bitcoin-denominated equity ETFs.

There’s even talk of Bitcoin spot ETFs surpassing physical gold ETFs in size. This would be a huge deal, showing a major shift in how people view Bitcoin as an investment and a store of value. It could challenge gold’s long-held position as the ultimate safe haven asset.

The fact that big players like Vanguard are exploring crypto ETF options shows that cryptocurrencies are becoming more accepted in traditional finance.