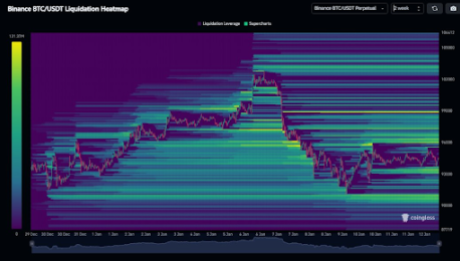

Bitcoin’s been hanging around $94,000 for the past week, with no clear direction. An analyst says this is because of big “liquidity blocks” between $86,000 and $104,000. This means there’s a good chance of either a jump to $104,000 or a drop to $86,000.

Massive Liquidity Blocks: A Tight Squeeze

Recent price action hasn’t given us much to go on. A crypto analyst, Kevin (@Kev_Capital_TA), points out huge blocks of buy and sell orders between $86,000 and $104,000. He thinks Bitcoin will bounce between these levels until the end of the month.

The Danger Zone: Below $86,000

But a fall below $86,000 could be bad news. There’s little support below that price, potentially leading to a crash down to $75,000.

The Bullish Breakout: Above $108,000

Bitcoin needs to break above $108,000 (its current peak) to really get the bullish party started. That would signal new all-time highs and a more sustained upward trend. Another factor to watch is USDT dominance (currently 3.7%). A decrease in USDT dominance suggests investors are moving from stablecoins into Bitcoin and other cryptos, which is generally a positive sign.

What Should You Do?

Kevin’s advice? Keep a close eye on things. Short-term traders should pay close attention to the choppy price movements. Long-term holders from the bear market might be more relaxed, as the overall outlook for Bitcoin is still bullish for 2025.

At the time of writing, Bitcoin is trading at $94,050, down slightly over the past 24 hours.