Glassnode, a cryptocurrency analytics firm, is signaling a potential shift in the Bitcoin market. Their analysis focuses on two key investor groups: short-term holders (STHs) and long-term holders (LTHs).

Short-Term Holders: A Key Indicator?

Glassnode is closely monitoring the average price at which STHs (those holding Bitcoin for less than 155 days) bought their coins. Historically, when Bitcoin’s price falls below this average cost, it often suggests a bearish market shift. Currently, Bitcoin is trading slightly above this crucial level, but a drop below could signal weakening investor sentiment.

Long-Term Holders: Selling, But Not Panicking

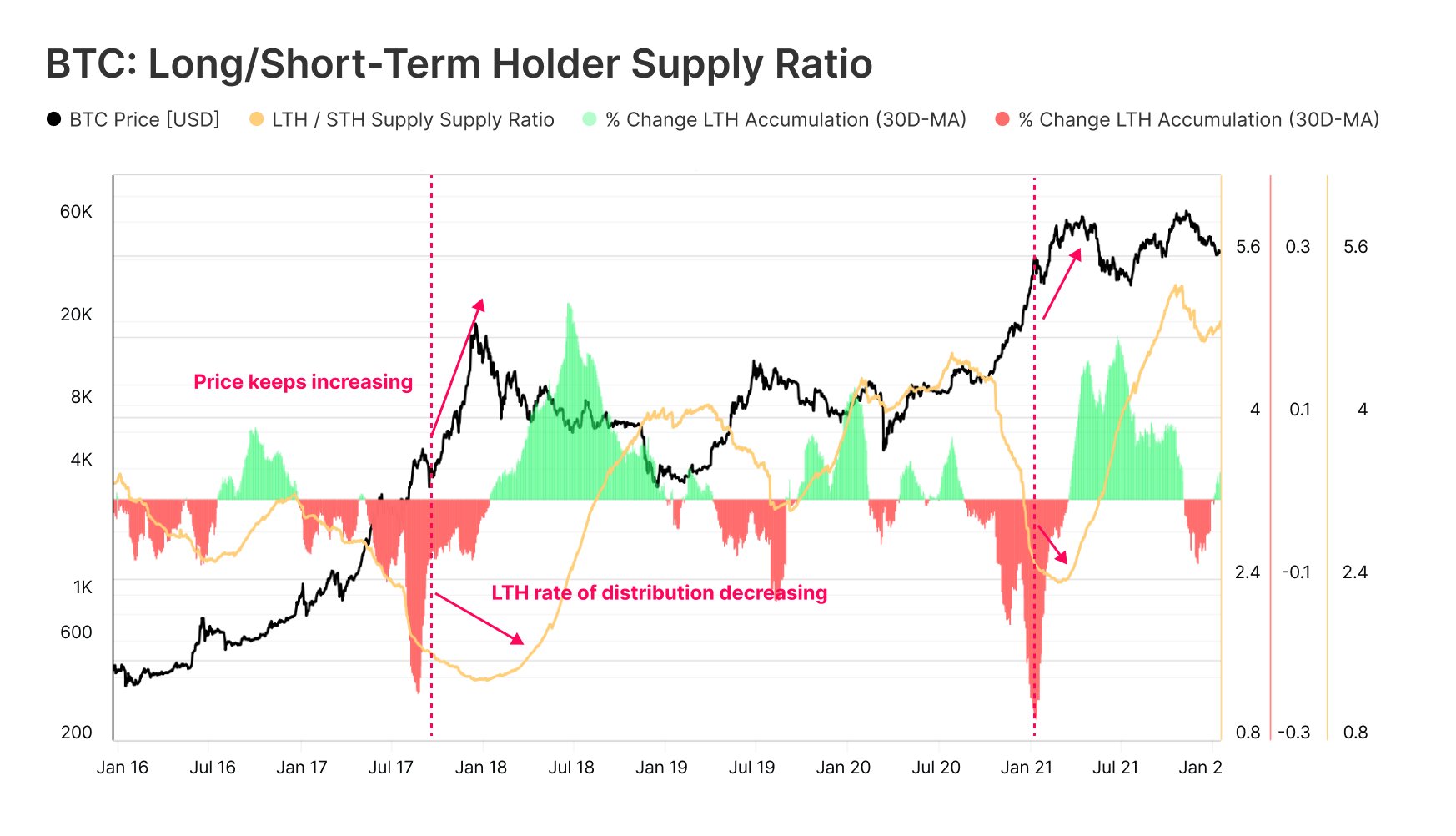

While long-term holders (those holding for 155 days or more) are selling their Bitcoin, Glassnode notes that the rate of selling has likely peaked. Interestingly, even with prices down from all-time highs, this selling pressure doesn’t automatically mean the bull market is over. Past cycles show that LTH selling can continue even as prices rise.

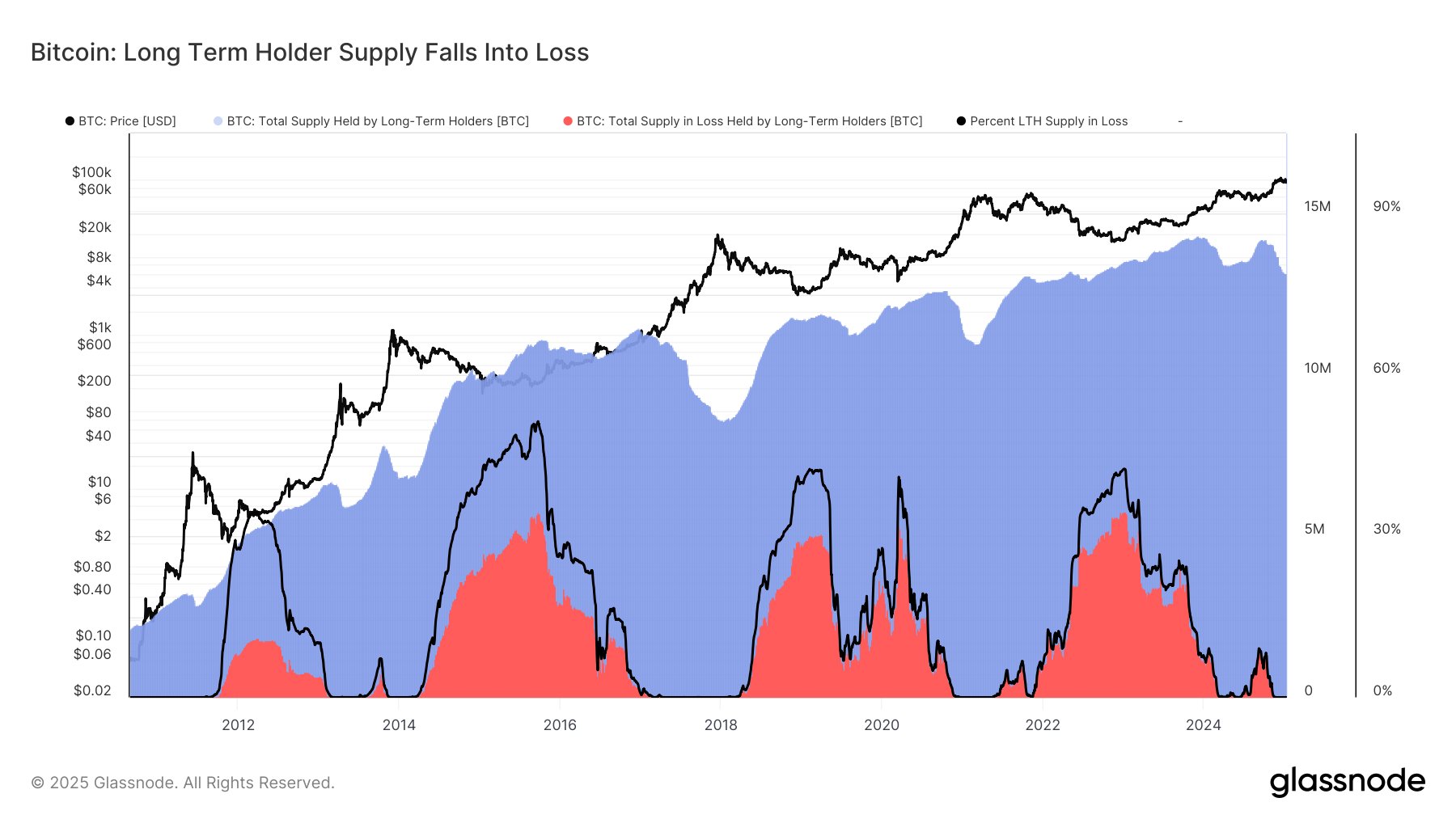

The Big Picture: Still Mostly Profitable

A significant factor to consider is that almost all LTHs are still in profit. In previous market downturns, prolonged and increasing losses among LTHs signaled the true end of a cycle. This isn’t currently the case.

Conclusion: Cautious Optimism

Glassnode’s analysis paints a mixed picture. While indicators suggest a potential turning point, the situation isn’t necessarily cause for immediate alarm. The continued profitability of LTHs and the peaking of LTH selling offer a degree of cautious optimism. However, investors should remain vigilant and monitor the market closely.