The launch of spot Bitcoin ETFs in the US last year was a huge deal for crypto. It was the biggest ETF launch ever, and these funds have become major players in the Bitcoin market.

A Year of Success

Before January 2024, the SEC was hesitant about approving Bitcoin ETFs. But once they gave the green light (to 11 applications!), things exploded. The first few days saw record-breaking trading volume. These ETFs opened the door for traditional investors to get into Bitcoin, and even big Bitcoin holders saw them as a smart, regulated way to invest.

Top Performers and Big Numbers

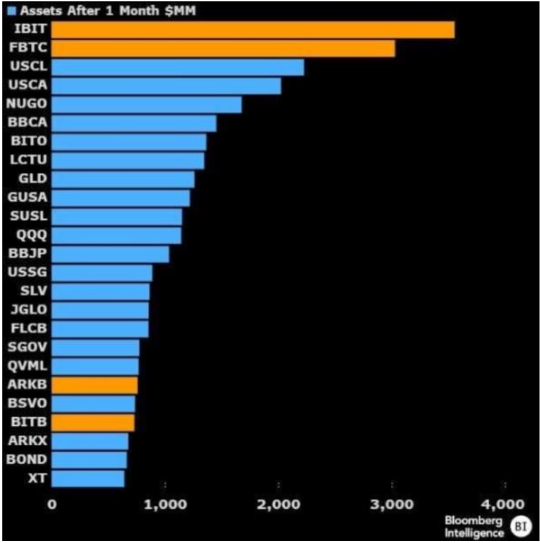

BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity’s Fidelity Wise Origin Bitcoin Fund were the early leaders, each attracting over $3 billion in investments in their first 20 days!

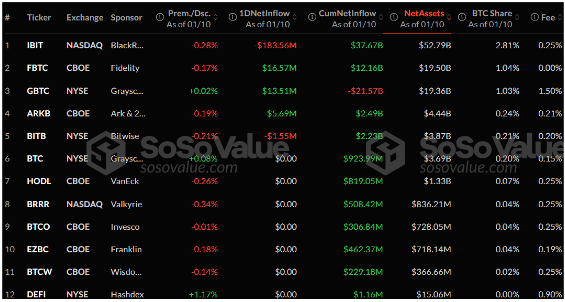

Currently, US-based spot Bitcoin ETFs hold around $107.64 billion in Bitcoin – that’s about 5.75% of the total Bitcoin market cap. In the past year, they’ve seen a total net inflow of $36.22 billion.

IBIT has seen the most inflow at $37.67 billion, followed by FBTC at $12.16 billion. These large inflows offset the $21.57 billion in net outflows from the Grayscale Bitcoin Trust (which was converted to a spot ETF). Other ETFs like ARK 21Shares and Bitwise also saw significant inflows (around $2.5 billion each). However, most others haven’t hit the $1 billion mark yet.

The Future Looks Bright (Probably)

The future for Bitcoin ETFs looks positive, especially with the expectation of more crypto-friendly policies under the incoming administration. Bitcoin is currently trading around $94,057. Many believe we’ll see even more money flowing into these ETFs in the coming years.