Ethereum’s price is making waves as 2024 winds down. Experts are watching closely, offering cautiously optimistic predictions based on key support and resistance levels.

Crucial Price Points

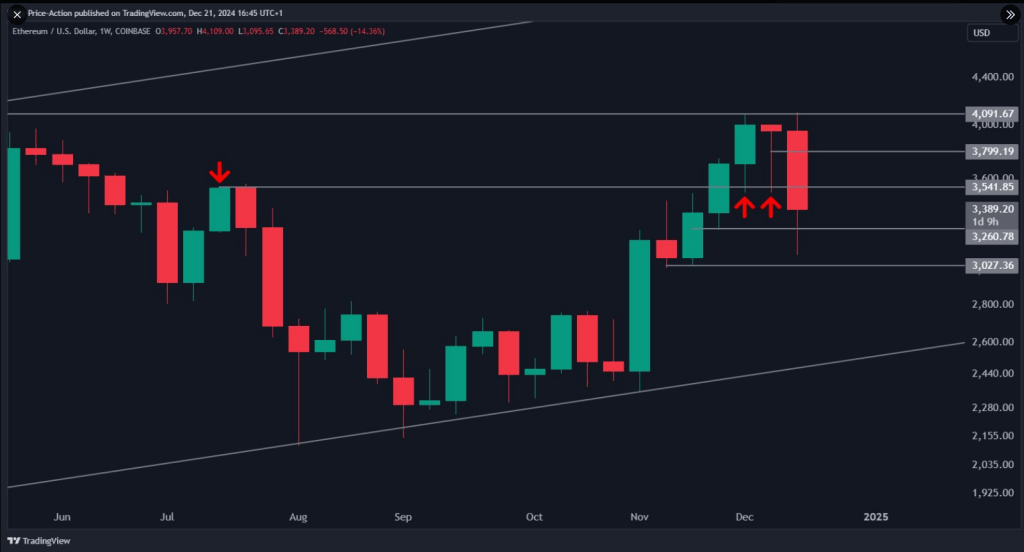

Analyst Justin Bennett highlighted the importance of Ethereum reclaiming $3,540 by December 22nd. Breaking this level would signal a bullish shift. Failure to do so could send the price tumbling below $3,000, potentially even down to $2,600 – a significant loss for investors. He emphasized that while the overall outlook for 2025 is positive, Ethereum needs to clear this hurdle to maintain bullish momentum.

Positive Market Sentiment and Predictions

Adding to the optimism, Titan of Crypto, using the Ichimoku cloud method, predicted a likely recovery. Their analysis suggests Ethereum has retested key levels, indicating the current correction might be nearing its end. The strong support from the Kumo Cloud suggests a potential base for further price increases if current levels hold.

Whale Activity and ETF Inflows

Big investors, or “whales,” are piling into Ethereum, accumulating around 340,000 ETH (over $1 billion) in just a few days. This significant buying spree shows growing confidence in Ethereum’s future. Meanwhile, US-listed spot Ethereum ETFs have seen over $2 billion in inflows since their launch, demonstrating increased investor interest. Analysts predict this could even surpass Bitcoin ETF inflows by 2025, especially if regulators allow staking yields within these funds.

Price Forecast and Outlook

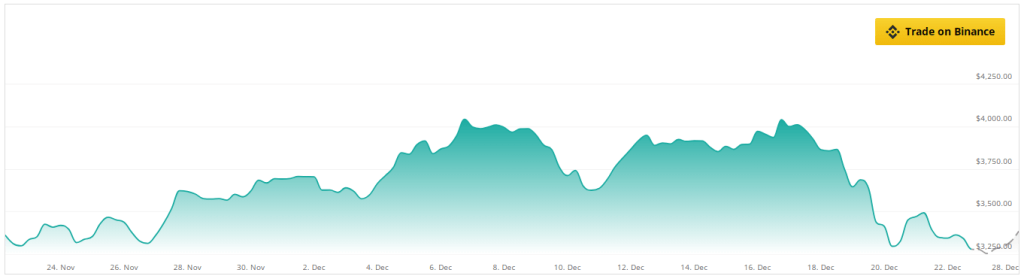

At the time of writing, Ethereum was trading around $3,330, slightly down. Despite the current red numbers, analysts remain hopeful. Technical indicators like the RSI and moving averages hint at a potential breakout, testing key resistance levels. The overall forecast is bullish, with predictions of a 35% price increase in the next three months and a potential doubling within a year.