Bitcoin recently hit a new all-time high, but then dropped over 11%. What’s the worst that could happen? Let’s explore.

Historical Patterns: Weeks 6, 7, and 8

A crypto analyst, Rekt Capital, looked at Bitcoin’s history. He noticed something interesting: weeks 6, 7, and 8 after a new high are often tricky. Looking back at 2013, 2016-2017, and 2021, Bitcoin frequently corrected during these weeks – sometimes dropping by a whopping 34% or more!

For example:

- 2013: A 75% drop in week 7.

- 2016-2017: A 34% drop in week 8.

These historical patterns suggest the current dip could be more than just a temporary blip.

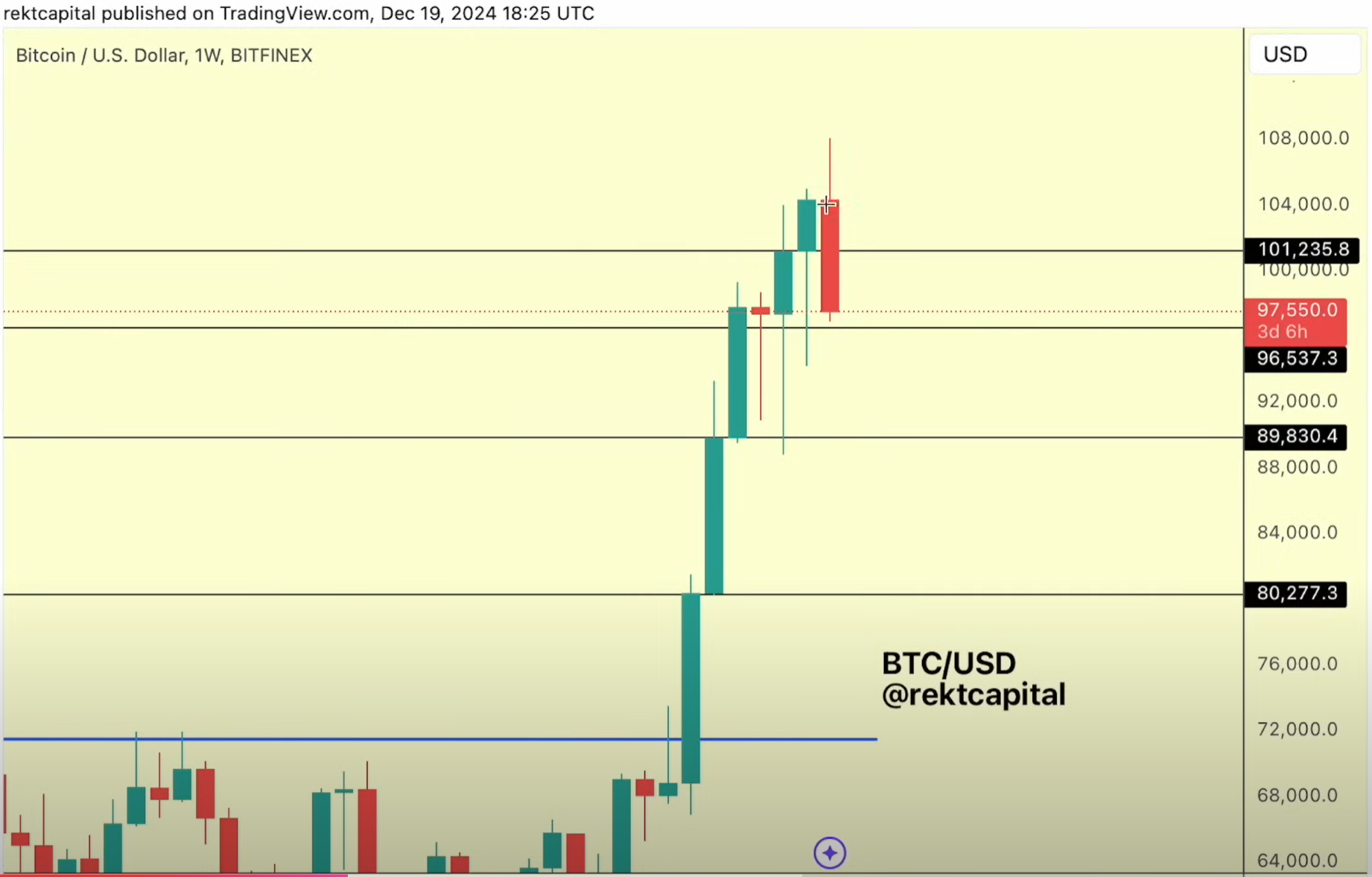

The Critical Support Zone

Bitcoin’s price has fallen into a historically important support zone around $96,537. This level has been crucial in the past for pushing Bitcoin higher. If Bitcoin breaks below this support, a more significant drop to around $89,830 could happen.

Bearish Signals

The analyst also pointed out some worrying technical indicators:

- Bearish Engulfing Candle: This shows a potential price reversal.

- Loss of Support: Bitcoin is losing previous support levels, which is a bearish sign.

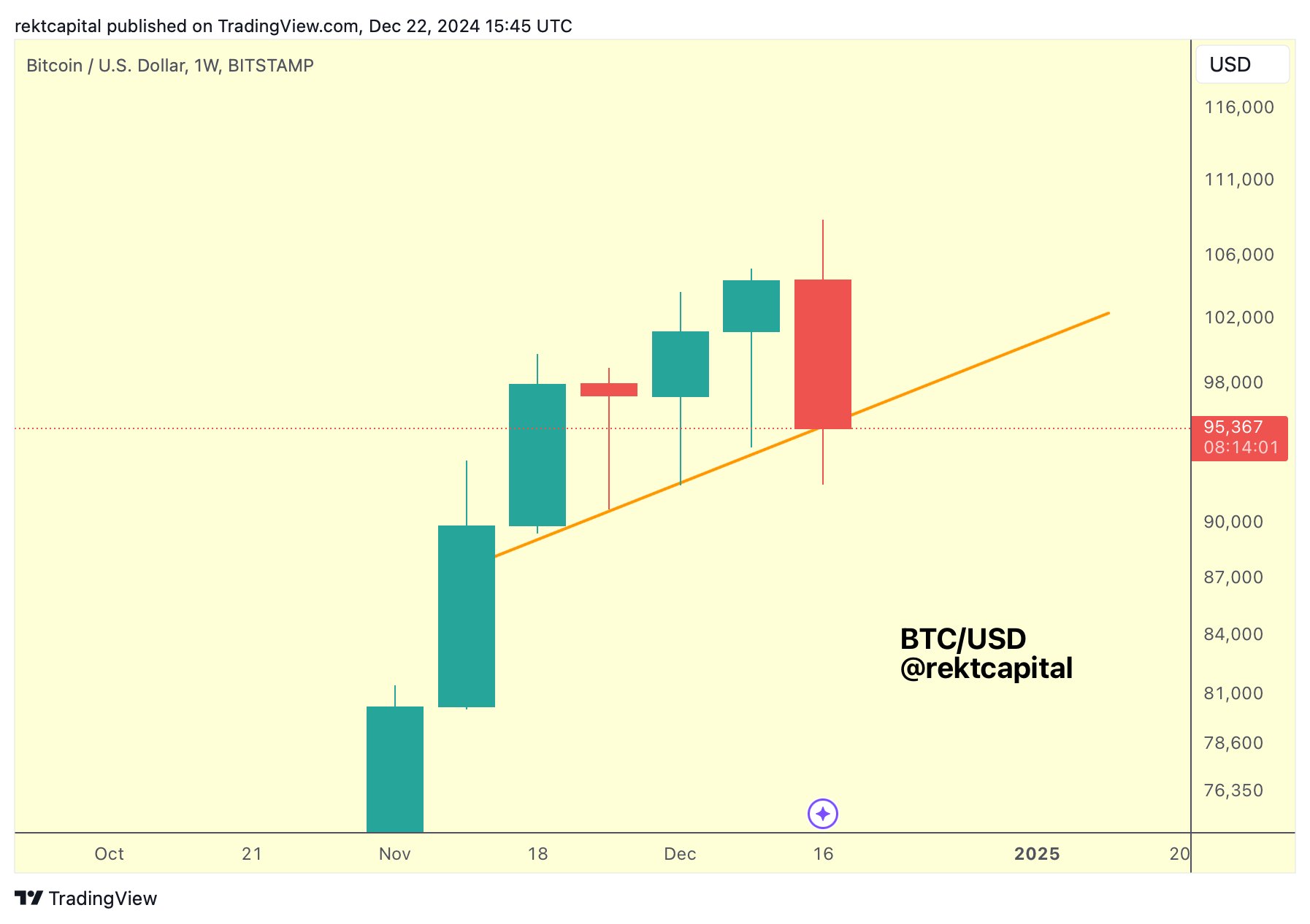

- 5-Week Trendline: If Bitcoin breaks below the 5-week uptrend line, it would strongly suggest a correction is underway.

The CME Gap

There’s also an unfilled gap in the CME futures market between $78,000 and $80,000. These gaps often get filled, and a significant drop (26-28%) could close this gap.

Long-Term Outlook: Still Bullish?

Despite these bearish signs, Rekt Capital remains optimistic in the long run. He argues that these pullbacks are normal and even necessary for future growth. Past cycles show that corrections often lead to further upward momentum. The current 10% drop might just be a breather before Bitcoin takes off again.

At the time of writing, Bitcoin was trading around $95,000.