Trump’s reelection in 2024 sparked a crypto market rally, largely due to his campaign promise to create a US Bitcoin reserve. This idea—using Bitcoin to offset national debt—has generated a lot of buzz.

Bitcoin as a Debt Solution?

Ki Young Ju, CEO of CryptoQuant, recently shared his thoughts on this. He argues that using Bitcoin to tackle US debt is a viable strategy.

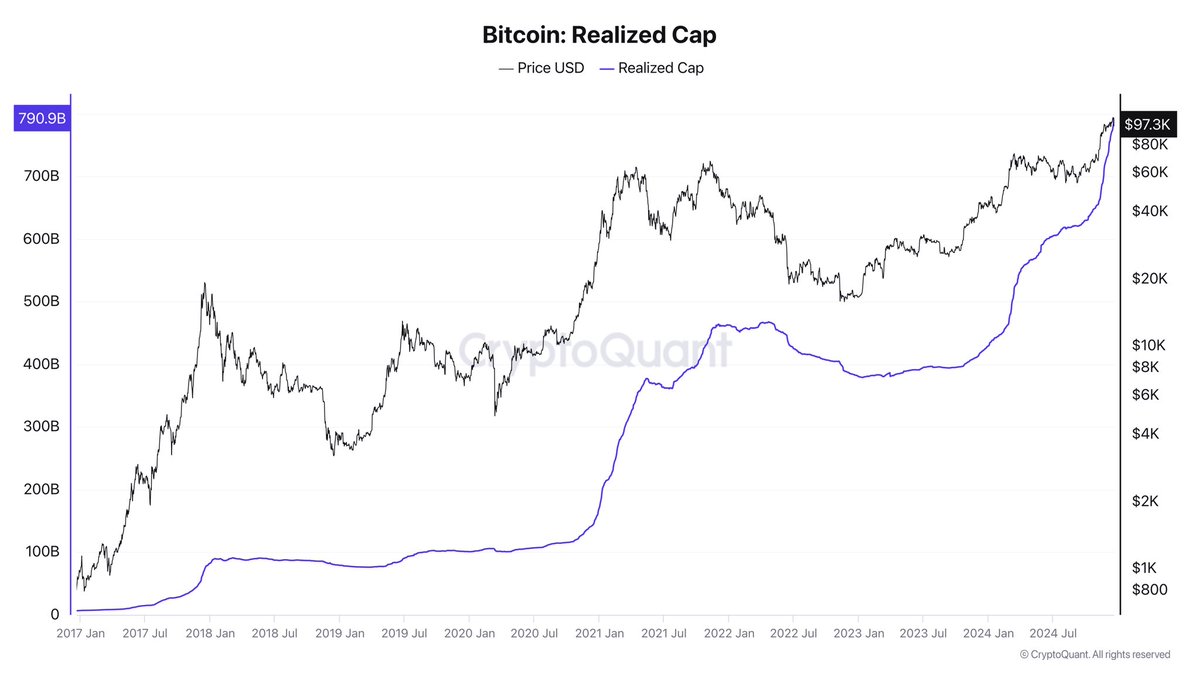

His reasoning? Over the past 15 years, massive capital inflows have driven Bitcoin’s market cap to trillions. He suggests that if the US government acquired 1 million Bitcoin by 2050 and designated it a strategic asset, it could reduce its domestic debt (70% of the total) by 36%. Even if foreign creditors don’t accept Bitcoin, it’s still a significant step.

Challenges and Risks

Ju acknowledges challenges. Getting creditors to accept Bitcoin in place of dollars could be tough. However, he sees a US Bitcoin reserve as a crucial step towards legitimizing Bitcoin globally, similar to how gold is viewed.

He also points out a potential risk: large Bitcoin holders (“whales”) might try to sabotage the initiative by selling off their Bitcoin. However, he believes that if governments keep accumulating Bitcoin and its price continues to rise, this risk diminishes.

Current Bitcoin Price

At the time of writing, Bitcoin is trading around $97,000, down slightly in the last 24 hours and a bit more over the past week.