Justin Sun, the founder of Tron, recently moved a huge chunk of his Ethereum – about $209 million worth – out of Lido Finance, a platform for staking Ethereum. This has some people worried about a potential Ethereum price crash.

Sun’s Ethereum Moves

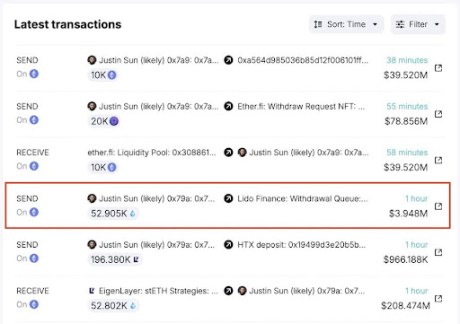

This wasn’t a small amount; we’re talking 52,905 ETH. Spot On Chain, a crypto analytics platform, revealed this massive withdrawal. It’s part of a larger picture: Sun reportedly bought a whopping $1.19 billion worth of ETH between February and August 2024. He’s already made a tidy profit of around $349 million on these purchases.

This isn’t the first time Sun has moved large amounts of ETH. He previously unstaked over $131 million worth and quickly transferred it to Binance, just before a 5% price drop in Ethereum. He’s also made other significant transfers to exchanges like HTX.

Could This Cause an Ethereum Crash?

Large sell-offs like this can put downward pressure on the price of a cryptocurrency. While Ethereum’s price has been doing relatively well recently (up over 7% in the last week and 28% in the last month), a significant sell-off by a major player like Sun could trigger a crash, especially if other big investors follow suit. The timing of Sun’s actions is also noteworthy, adding to the uncertainty.

What Happens Next?

The big question is: will Sun continue selling his ETH? He hasn’t said anything publicly, but the sheer size of his recent transactions is certainly making people nervous. The Ethereum market is already a bit shaky, so more selling could cause significant volatility. For now, we’ll have to wait and see what happens.