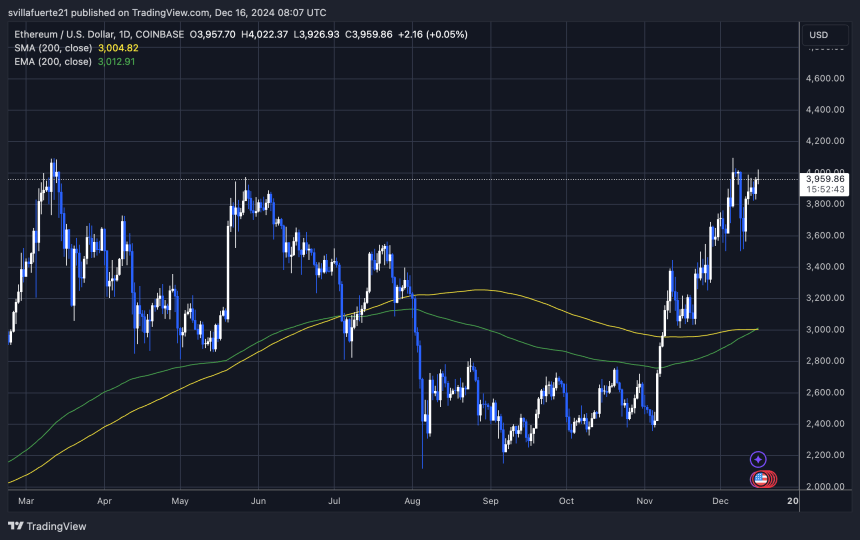

Ethereum is getting close to its all-time high, nearing the $4,000 mark. While some experts thought it wouldn’t perform as well as in previous bull runs, it’s been steadily climbing recently.

Whale Watching: A Key Indicator

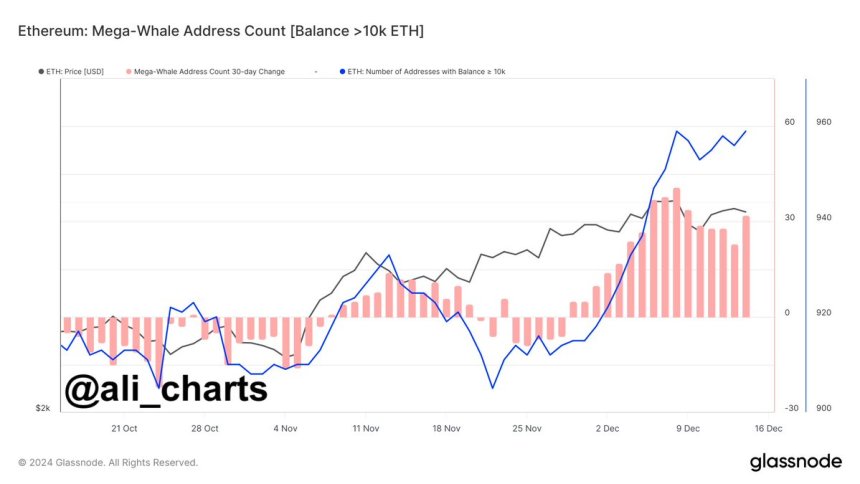

Data shows something interesting: Big Ethereum holders (whales) have been buying up a lot of ETH since late November. This is a significant sign because historically, whale accumulation often predicts big price increases. It suggests these major players believe the price will go up.

The Bullish Case: Smart Money is In

A top analyst pointed out that this accumulation started when the price passed $3,330. This suggests that experienced investors are anticipating a substantial price jump in the coming months. They usually see market shifts before smaller investors do.

The Bearish Counterpoint: A Potential Trap?

However, there’s a downside. This whale activity could also be a “bull trap.” If the market changes, or Bitcoin’s dominance increases, these whales might quickly sell their ETH, causing a sharp price drop that could hurt smaller investors.

The $4,000 Hurdle: Make or Break?

Ethereum is currently around $3,950, struggling to break through the $4,000 resistance level. Breaking through this psychological barrier would be a huge positive, confirming the upward trend. Failing to do so could lead to a price drop towards $3,500. However, Bitcoin’s recent surge and the overall positive sentiment around altcoins are creating a bullish environment. Combined with the whale accumulation, many believe Ethereum could reach its all-time high again.