Solana’s recent price action has been interesting. While it’s seen a bit of a dip after hitting a new high, the underlying investor behavior suggests a strong belief in its future.

Long-Term Holders are Increasing

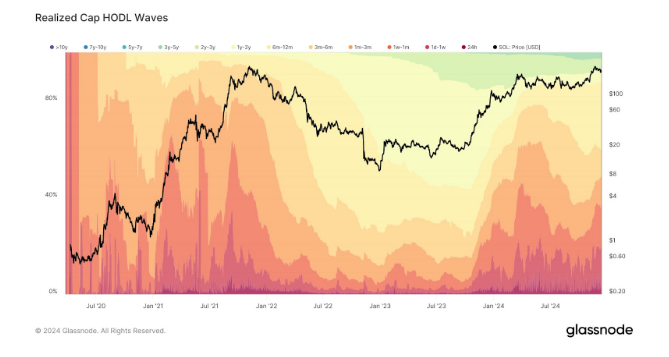

Data shows a significant increase in long-term Solana holders. Many investors who jumped in during the recent rally are holding onto their SOL, indicating confidence in the project’s long-term potential. The number of addresses holding Solana for 6-12 months is up to 27% of the total supply. These “medium-term accumulators” aren’t showing signs of selling anytime soon. This suggests that Solana is attracting genuine long-term investors, not just short-term speculators.

A Changing of the Guard

Interestingly, the group of investors who held Solana for 1-2 years has significantly shrunk. This group, which was a huge chunk of the supply earlier this year, has cashed out a lot of their profits. Their departure leaves the market with fewer potential sellers and more new, optimistic holders.

What This Means for Solana’s Price

This shift in holders is a positive sign. With fewer long-term holders looking to sell and new investors holding strong, the balance of supply and demand looks good for another price increase. Technical analysis also supports this positive outlook, with some analysts predicting new all-time highs before the end of the year, even suggesting a potential price surge towards $4000. While Solana’s price has dropped slightly recently, it’s still holding above $200, which is a bullish indicator.