Bitcoin just smashed the $100,000 mark—a huge milestone! But now everyone’s wondering: is this the peak? Will the price keep climbing, or are we about to see a crash?

What the Whales Are Doing

One analyst looked at something called the “realized profit ratio.” This basically shows how many people are selling Bitcoin at a profit. A high ratio means lots of people are cashing out, suggesting a market peak is near. A low ratio? That means fewer people are selling, hinting at continued confidence in Bitcoin’s future price increases.

The analyst found that the ratio for Bitcoin whales (those holding huge amounts of Bitcoin) is surprisingly low compared to previous cycles. This suggests whales aren’t selling yet, implying they believe the price will go even higher. They’re betting big!

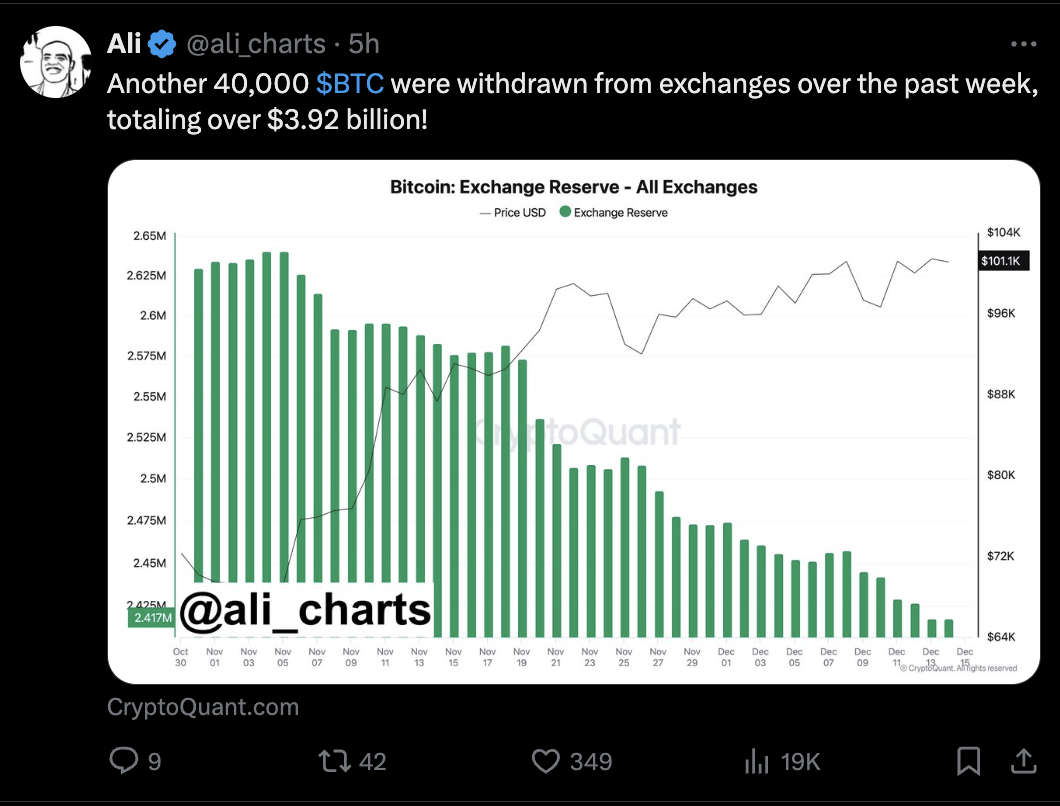

More Evidence: Bitcoin Exiting Exchanges

Adding to this, a lot of Bitcoin has recently left centralized exchanges. Over 40,000 BTC (that’s billions of dollars!) moved to individual wallets. This is a strong signal that investors are holding onto their Bitcoin for the long haul, rather than looking for quick profits.

The Bottom Line

Both the low realized profit ratio among whales and the large amount of Bitcoin leaving exchanges point to one thing: many believe Bitcoin’s price still has room to run. Whether they’re right remains to be seen, but it’s a pretty bullish sign for now.