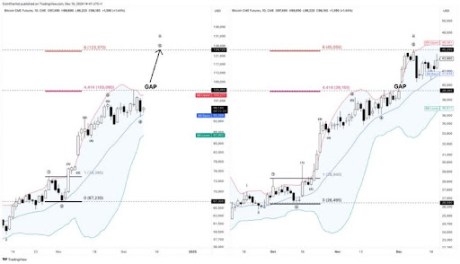

A crypto analyst has noticed some seriously spooky similarities between Bitcoin’s price charts from late 2023 and late 2024, specifically looking at the Chicago Mercantile Exchange (CME) data. The charts are practically twins!

Spooky Similar Charts

The analyst, Tony Severino, posted a comparison on X (formerly Twitter) showing how the November/December price action in both years looks almost identical. We’re talking matching wave patterns, similar price movements, and even the same key indicators.

Elliott Waves and Bollinger Bands

Both charts show a classic five-wave bullish pattern (according to Elliott Wave theory). Plus, the Bollinger Bands – a tool used to spot short-term price swings – are expanding similarly in both years. This suggests a strong upward trend could continue. In both 2023 and 2024, Bitcoin’s price hugged the upper Bollinger Band, a clear bullish signal.

Fibonacci Echoes

The similarities don’t stop there. Severino found that the Fibonacci extension levels – another technical analysis tool – were almost identical in both years. In 2023, Bitcoin rallied to hit the 4.416 and 6 Fibonacci levels, reaching roughly $39,265 and $45,250 respectively. If 2024 follows the same pattern, Bitcoin could potentially hit $105,465 and $124,125.

CME Gaps

Another eerie similarity? Both charts show similar “gaps” in the CME futures data. A gap happens when the closing price and opening price of Bitcoin on the CME are different. In 2023, Bitcoin’s price rally filled one of these gaps. The 2024 chart also shows a similar gap, around the $124,125 mark.

Bitcoin Could Hit $120,000?

Based on all these similarities, Severino predicts Bitcoin could surge past $120,000. This prediction is based on the strong resemblance between the 2023 and 2024 charts, particularly the Fibonacci levels. While Bitcoin recently hit a new all-time high above $104,000 before a quick dip (which some called a “flash crash”), it’s currently trading around $97,638 and showing signs of recovery. If this bullish trend continues, that $120,000 target might be within reach.