Bitcoin’s price has been on a rollercoaster lately! One minute it was hitting six figures, the next it was “flash crashing” down to under $90,000. Let’s break down what happened and what it means.

The Flash Crash Explained

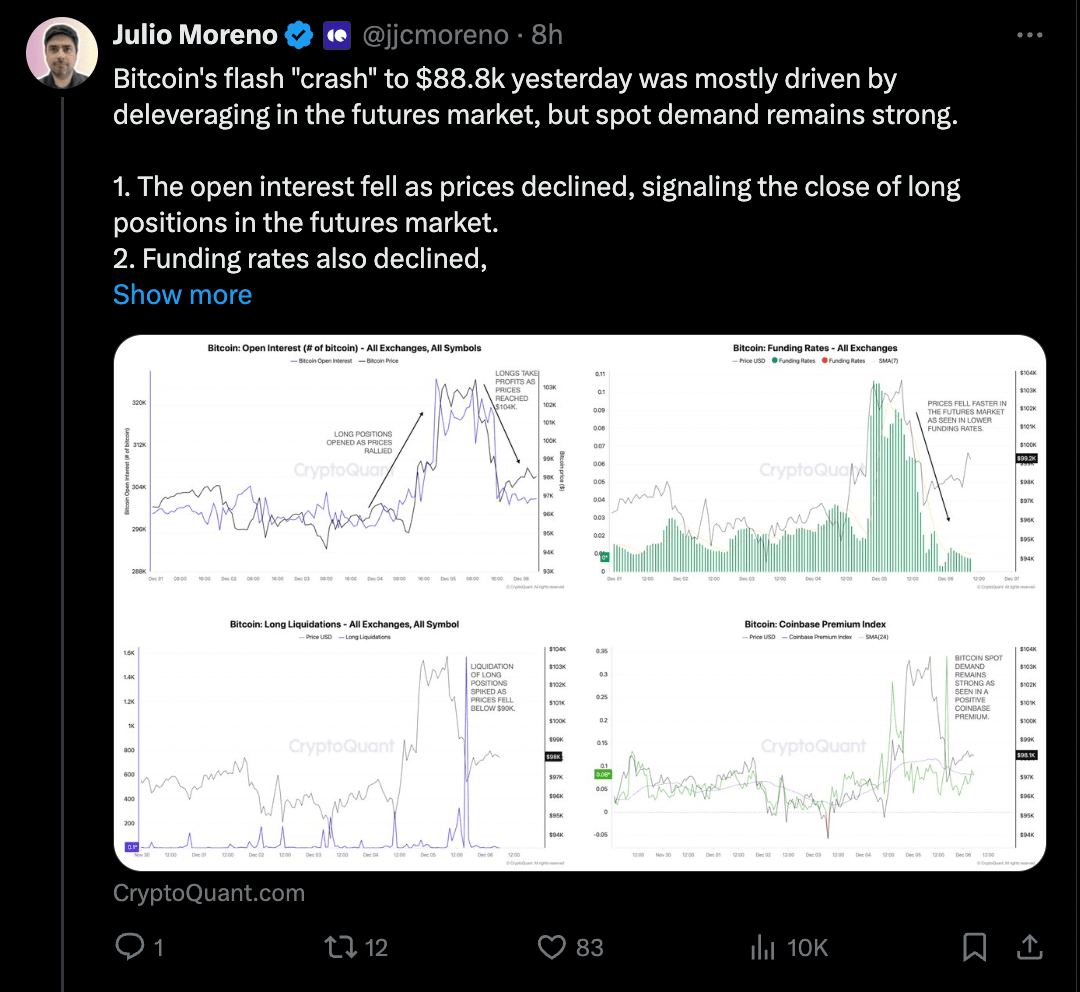

A “flash crash” is when an asset’s price suddenly plummets, only to recover almost immediately. This happened to Bitcoin on December 5th, dropping to around $88,800. According to CryptoQuant’s head of research, Julio Moreno, this was caused by a domino effect of selling and margin calls in the Bitcoin futures market.

Futures Market Fallout

- Less Interest: As the price fell, the number of open futures contracts (open interest) shrank. This means many leveraged long positions (bets that the price would go up) were liquidated.

- Negative Funding Rates: Funding rates, which are payments between traders in the perpetual futures market, turned sharply negative. Negative rates mean the market is bearish (expecting lower prices), with short traders (betting on price drops) willing to pay a premium. This indicated that futures prices were falling faster than the spot price of Bitcoin. Negative funding rates during a crash often signal further price drops are expected.

Spot Market Strength

Interestingly, even with the chaos in the futures market, the spot market (where Bitcoin is bought and sold directly) showed surprising strength. The Coinbase Premium, which compares Coinbase’s price (a spot exchange) to other exchanges (often more futures-focused), went strongly positive. This suggests strong buying interest from US investors.

Bitcoin’s Current Status

At the time of writing, Bitcoin is trading just below $100,500, up 2% in the last 24 hours. Its market cap is over $2 trillion.