Bitcoin’s price recently dropped below $100,000. This dip seems linked to some long-term holders finally selling their coins.

Long-Term Holders on the Move

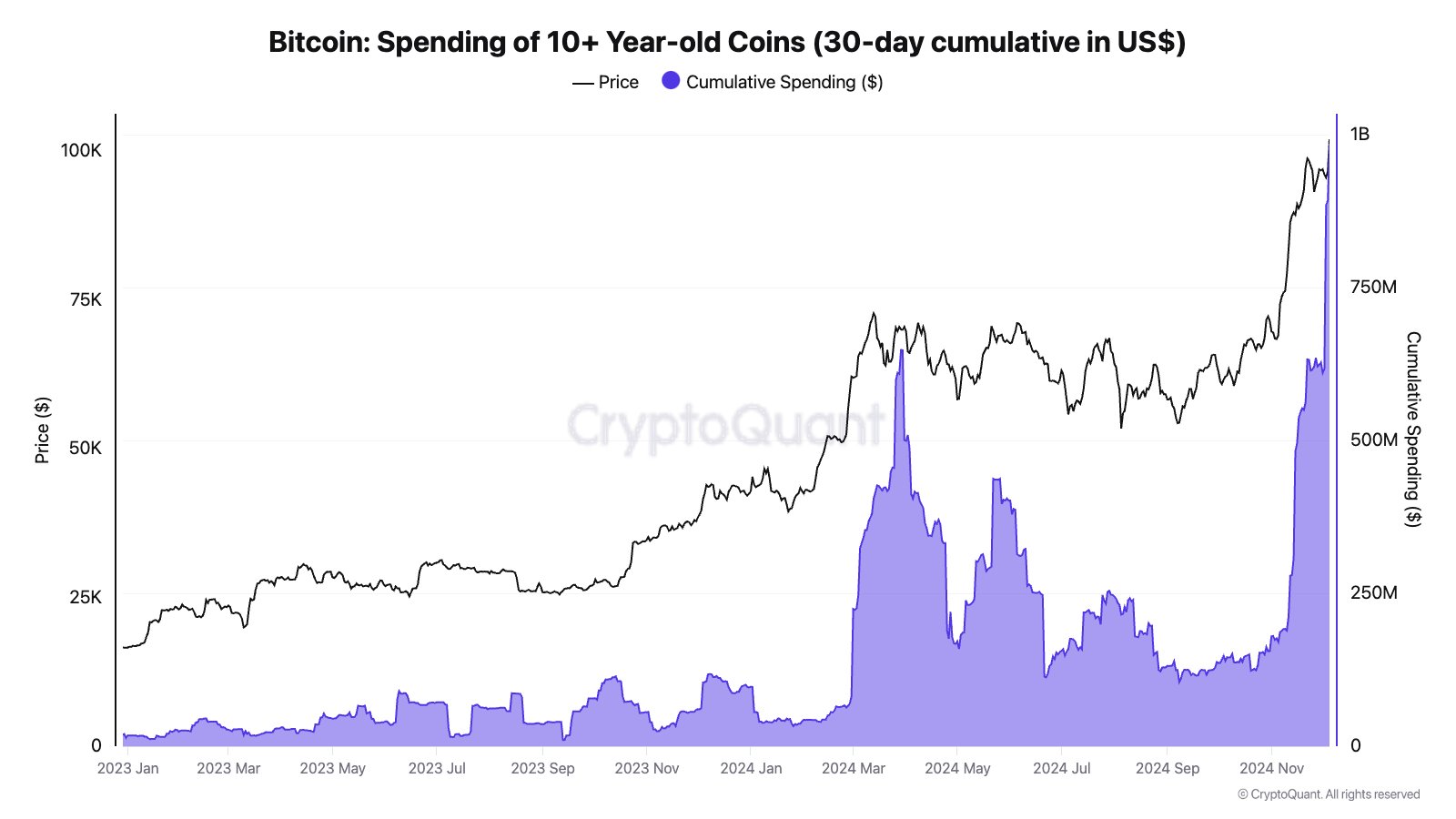

Data shows that Bitcoin held for 10+ years has seen significant movement recently. Analysts tracked the total amount of these “ancient” coins moved in the last month. The chart showed a massive increase in activity.

Usually, the longer someone holds Bitcoin, the less likely they are to sell. This is especially true for coins held for over 155 days (considered “long-term holders” or LTHs). However, coins older than 7 years are more likely to be lost than actively held. This means some of the recent sales might be from people rediscovering old wallets, not necessarily long-term investors deciding to sell.

The Diamond Hands Decide to Sell?

Despite the possibility of lost coins resurfacing, some of the sellers are likely long-term holders who bought Bitcoin back in 2014 or earlier. It seems they were happy with the price hitting $100,000 and decided to take profits. In the month leading up to the price drop, these long-term holders moved nearly $1 billion worth of Bitcoin. This selling pressure could have contributed to the recent price decline.

Current Bitcoin Price

At the time of writing, Bitcoin is trading around $97,700, a drop of over 5% in the last 24 hours.