XRP’s price has skyrocketed, climbing past $1.62 and getting dangerously close to $2. This incredible surge—over 50% since last Tuesday—has everyone talking. But is it all good news?

A Pump Fueled by Leverage?

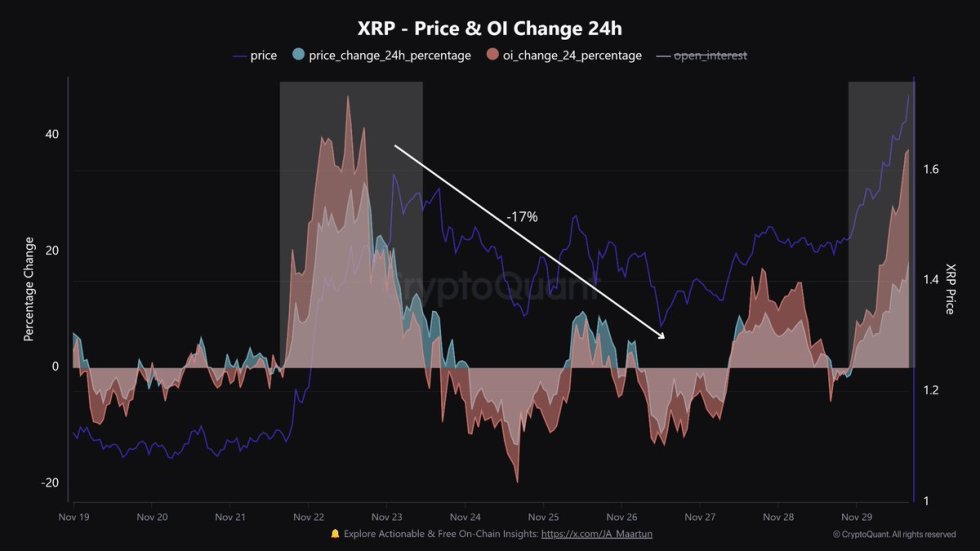

While the price action looks amazing, analyst Maartunn suggests this rally is mostly due to leveraged trading, not actual increased demand. This means a lot of people are betting big, and if things go south, the correction could be brutal. Think of it like a house of cards – a single gust of wind could bring the whole thing down.

The $2 Question: Can the Bulls Keep Running?

XRP’s price has exploded by over 285% in under a month. That’s insane! But can this pace continue? Some think this is the start of a massive bull run, while others see it as a clever exit strategy for big players (whales) who are cashing out at the expense of smaller investors. This “exit liquidity” scenario is a real concern.

The Numbers Don’t Lie: Open Interest Explodes

Maartunn’s analysis shows a huge jump (37%) in Open Interest (OI), which basically means a massive increase in leveraged trading. While leverage can boost profits, it also makes things super volatile and risky. He even points to a similar past event that led to a 17% price drop. Yikes!

Price Action: What to Watch

XRP is currently trading around $1.92, having just broken through the $1.60 resistance level. The next big hurdle is $1.96, followed by the coveted $2 mark. Breaking $2 would be a huge psychological win for XRP bulls, potentially leading to even higher prices.

However, a failure to hold above $2 could trigger a correction, potentially sending the price back down to around $1.60. The next few days will be crucial in determining whether this rally continues or fizzles out. Keep an eye on trading volume and overall market sentiment – those will be key indicators.