Bitcoin’s price is climbing, but some key indicators are flashing red. This means we might be heading for a correction.

Warning Signals: What the Data Says

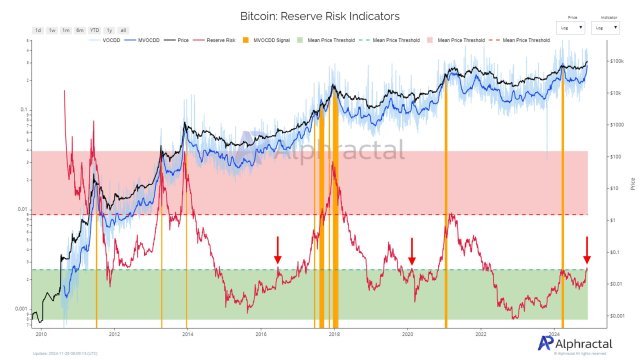

A recent report from Alphractal, a data analysis firm, points to some worrisome trends. Two key metrics are raising concerns:

-

Reserve Risk: This measures the relationship between Bitcoin’s price and the confidence of long-term holders. High levels suggest a correction is likely. Think of it like this: if long-term holders are starting to sell, it’s a bad sign. Currently, it’s at a historically high level.

-

MVOCDD Signal: This more complex indicator helps predict market peaks and volatility by tracking how often older Bitcoins are being traded. A rise in this signal often precedes a market peak. It’s also significantly up recently.

Essentially, these indicators are suggesting Bitcoin might be overbought.

Parabolic Potential, or Price Drop?

While the risk indicators are flashing warnings, the market isn’t completely overheated. Alphractal suggests that any price drop could be a buying opportunity.

However, if the Reserve Risk indicator leaves the “safe zone” (the green quadrant), we might see a parabolic move – a rapid price increase followed by a sharp crash. This is based on past market cycles.

Current Market Conditions

Bitcoin’s price is up slightly today, but trading volume is down significantly. This suggests that investor interest might be waning. This lower volume could mean less support for the price if it starts to fall.