Tron’s Sharpe ratio is spiking, and history suggests this could be bad news for TRX’s price.

What is the Sharpe Ratio?

The Sharpe ratio measures how much extra return you get for taking on extra risk. A higher ratio sounds good, but in Tron’s case, a very high ratio might mean things are getting too risky. It compares the asset’s return to a risk-free return (like a government bond), adjusted for volatility. Basically, it helps determine if the potential reward is worth the risk.

The Warning Signs

A recent analysis shows Tron’s 180-day Sharpe ratio is flashing a major warning sign. The ratio has surged into a “red zone,” a level that has historically coincided with TRX price peaks in the past. The chart below illustrates this correlation.

[Insert chart here if available]

While the current Sharpe ratio isn’t as high as it was during previous peaks, it’s still in that risky territory. This means potential gains are limited, while the chance of a significant price drop is much higher. Holding TRX in this situation could be a bad long-term strategy.

Short-Term vs. Long-Term

While TRX might continue climbing in the short term, experts warn that holding onto it in this high-risk zone is dangerous. The potential for big losses outweighs the potential for further gains.

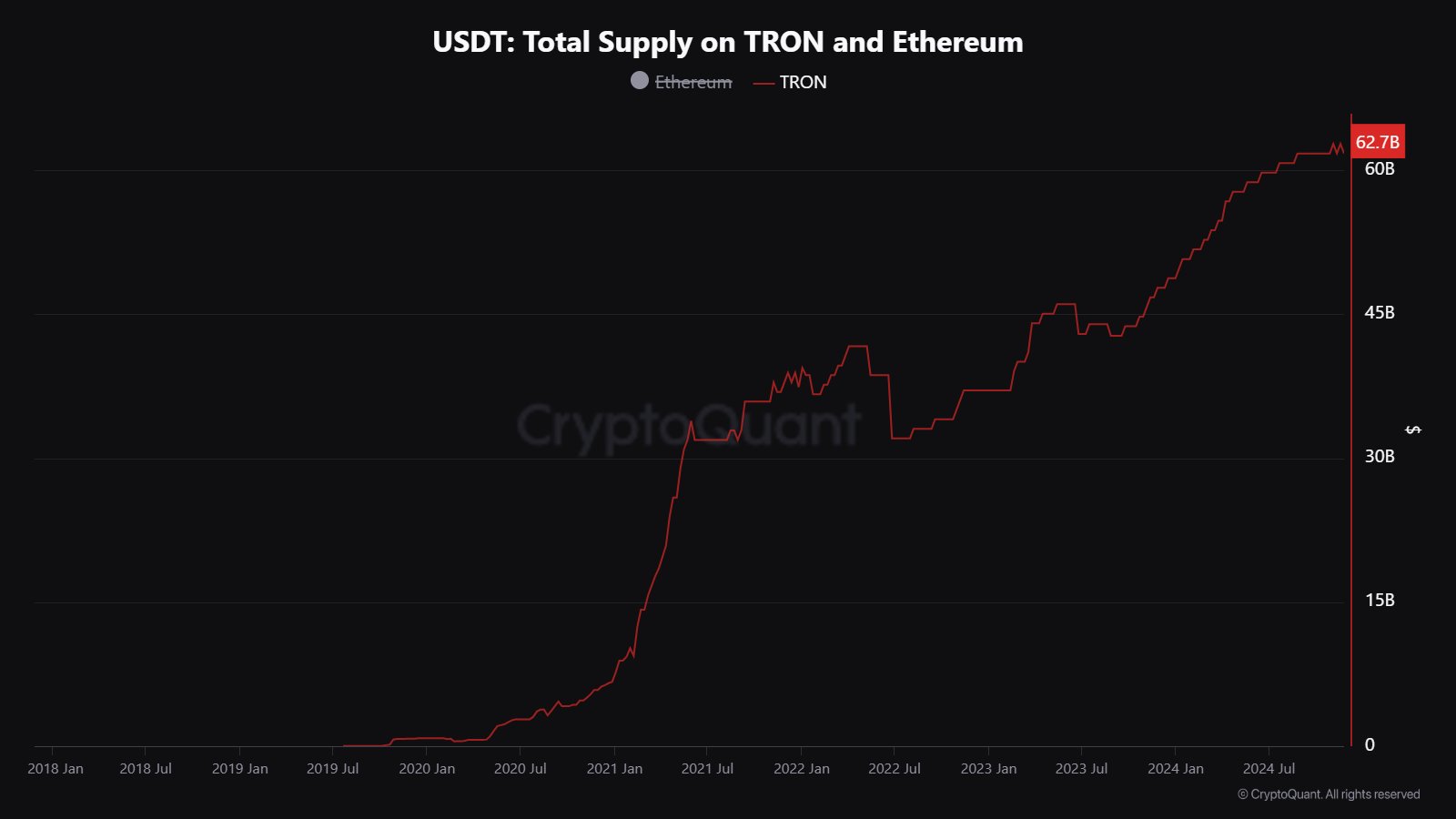

USDT on the Tron Network is Booming

Interestingly, the amount of Tether (USDT) on the Tron network has exploded over the past year – a 37% increase! This shows growing interest in using USDT on the Tron blockchain.

Current TRX Price

TRX recently broke through $22, but the upward momentum seems to be slowing. The price is currently hovering around $20.

The Bottom Line

The high Sharpe ratio is a serious warning sign for TRX. While a short-term price increase is possible, the risk of a significant drop is substantial. Investors should proceed with caution.