Ethereum’s price is surging! After a strong week with almost a 10% increase, it’s breaking through major resistance levels. Talk of a new all-time high by year’s end is heating up. Even Ethereum futures trading is seeing a boost, showing traders are feeling pretty bullish.

Is There More Room to Grow?

Crypto analyst ShayanBTC has weighed in on this Ethereum rally. They’re looking at funding rates – a key indicator of trader sentiment in futures markets. Higher funding rates generally mean more people are betting on the price going up.

Shayan notes that Ethereum’s funding rates are climbing, showing increased demand for long positions (bets that the price will rise). However, they’re still below the levels seen at Ethereum’s previous all-time high, meaning the market isn’t overheated yet.

While positive, high funding rates can also be a warning sign. Historically, huge jumps in funding rates have been followed by price crashes. But Shayan thinks Ethereum’s current rates are manageable, suggesting there’s still room for growth before things get risky.

Ethereum’s Recent Performance and Future Predictions

Ethereum’s been on a tear lately, with about a 15.6% jump in the last two weeks. It’s smashed through the $3,500 resistance level and is aiming for $4,000 next. Currently trading around $3,563 (a slight dip from its recent high), it’s only about 27% away from its all-time high.

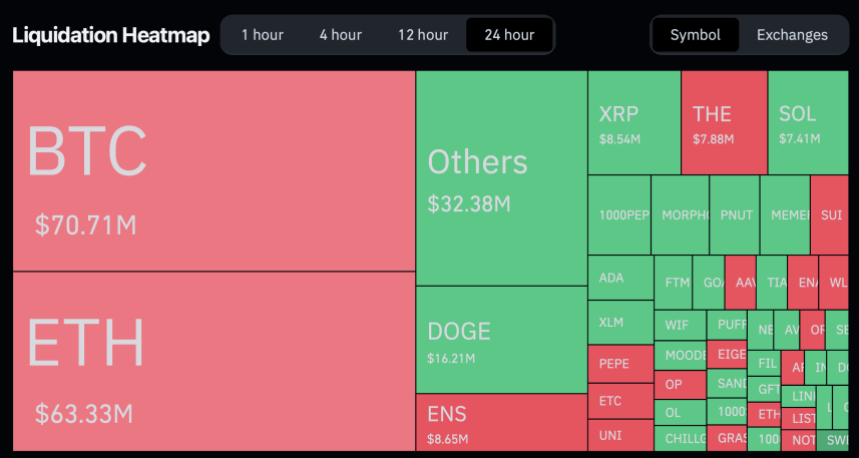

It’s not all sunshine and rainbows though. Coinglass data shows that $278 million worth of crypto positions were liquidated in the last 24 hours, with $63.33 million of that being Ethereum (a mix of both long and short positions).

Despite the recent price action, crypto analyst Ali maintains their prediction of Ethereum reaching $6,000 mid-term and $10,000 long-term.