Bitcoin’s price has cooled a bit after a huge run, failing to hit the coveted $100,000 mark. But don’t worry, investors aren’t giving up!

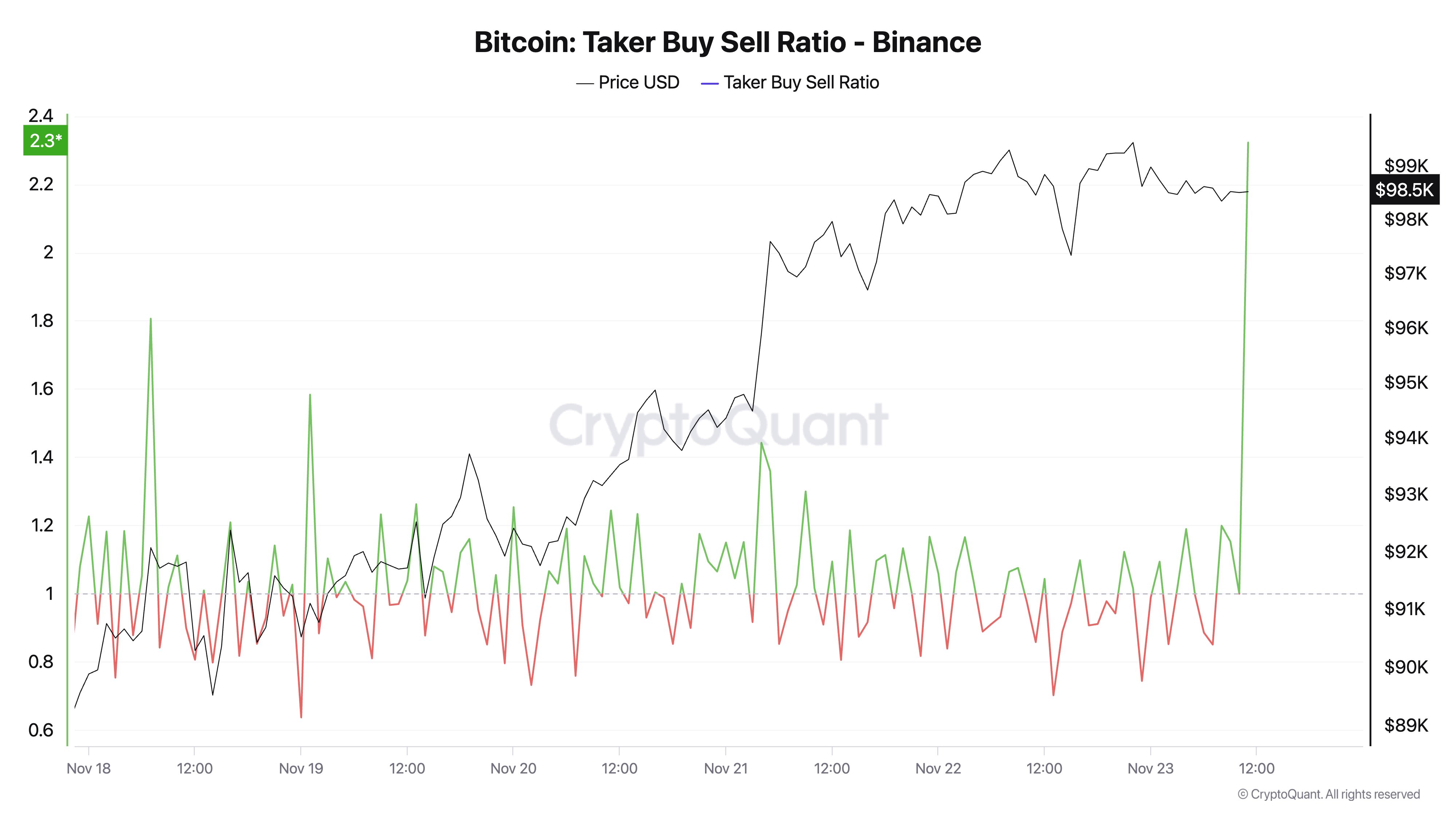

The Buy/Sell Ratio is Soaring

A crypto analyst, Ali Martinez, noticed something interesting: the Bitcoin “taker buy/sell ratio” is way up. This ratio shows the difference between the volume of Bitcoin bought and sold on exchanges. A ratio above 1 means more buying than selling – a good sign!

Martinez saw a huge spike in this ratio on major exchanges like Binance, OKX, HTX, and Bybit. Binance, the biggest exchange, even hit a ratio over 28! This shows serious buying pressure. While Bitcoin’s price dipped slightly (around 1.1% in 24 hours), it’s still up almost 8% for the week.

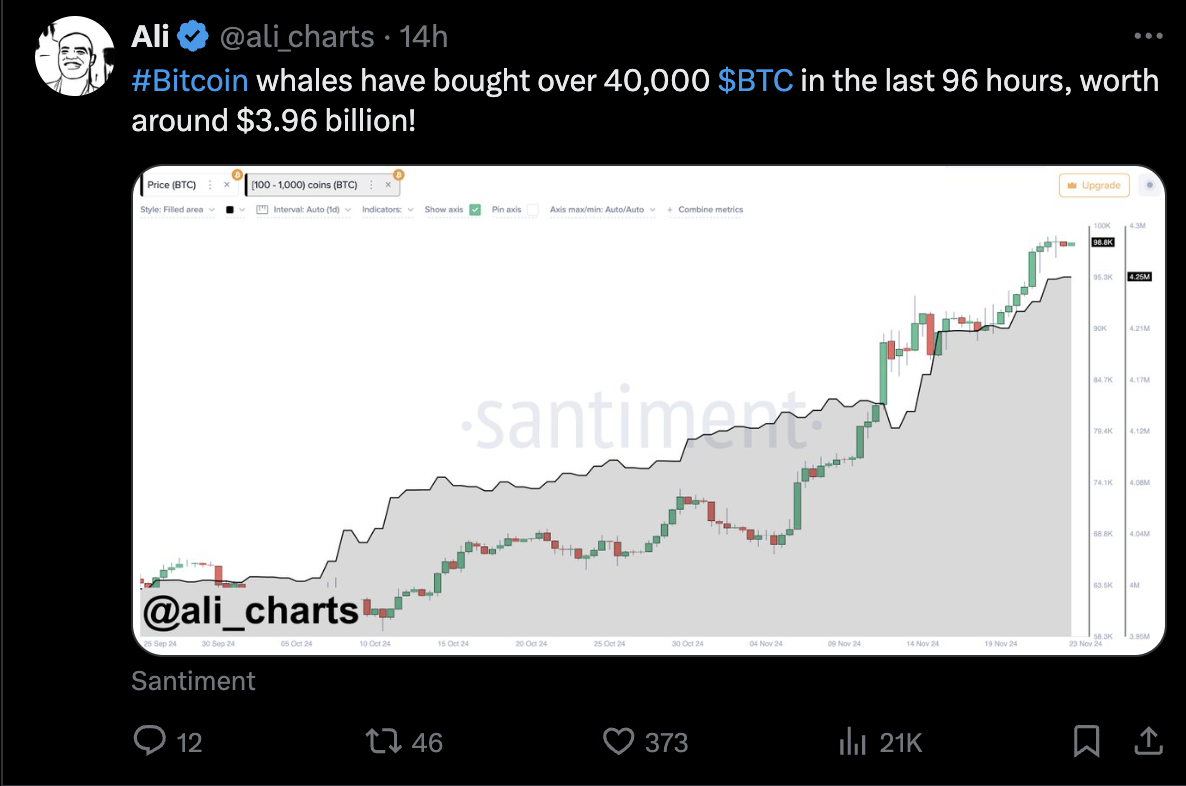

Who’s Behind the Buying Frenzy?

Martinez also pointed out that big Bitcoin investors (“whales,” those holding 100-1000 BTC) have been very active. Data shows these whales bought over 40,000 BTC (about $3.96 billion!) in just four days. Their buying power could really push the price up.

In short, despite a recent price dip, strong buying pressure from both regular traders and whales suggests Bitcoin could still be on its way to $100,000.