Bitcoin’s price has been on a tear lately, hitting new all-time highs. Everyone’s wondering: will it hit $100,000? While some focus on short-term gains, others are looking at the bigger picture. Recent data suggests a potential price correction might be coming sooner than we think.

High Funding Rates: A Bullish Sign or Warning?

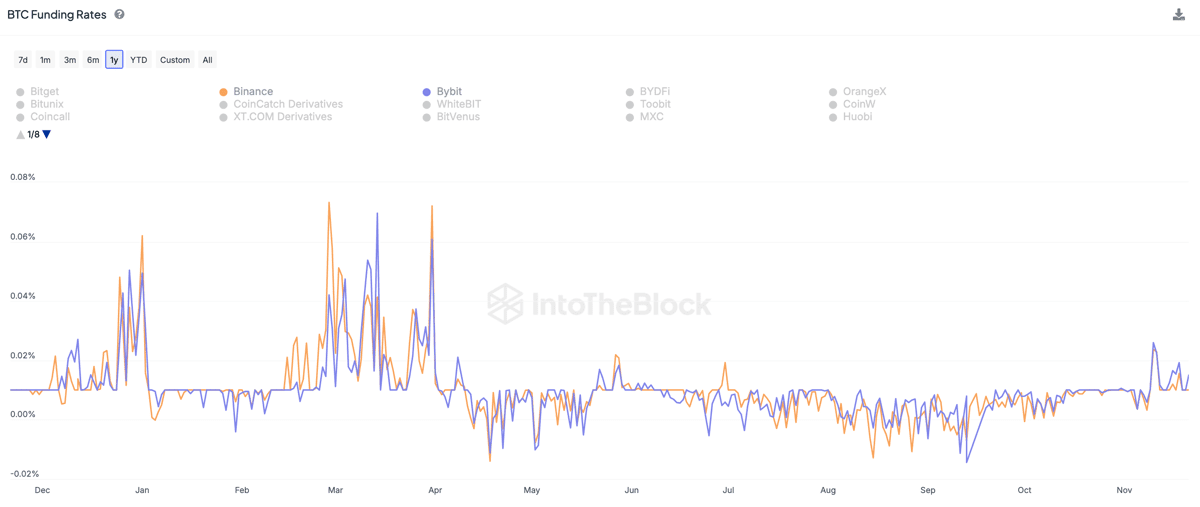

IntoTheBlock, a market intelligence platform, shows a significant jump in Bitcoin funding rates. These rates reflect payments between traders in the futures market. High, positive rates mean long-term bettors (those expecting the price to go up) are paying short-term bettors (those expecting the price to go down). This usually signals strong bullish sentiment.

Conversely, negative rates indicate bearish sentiment. IntoTheBlock reports a 10-20% increase in Bitcoin funding rates on major exchanges. While this points to strong bullish sentiment, it also raises concerns about speculative overheating and potential market corrections.

One possible reason for this bullishness? Speculation about the US government’s approach to crypto under a new administration. The idea of the US holding Bitcoin reserves is fueling investor optimism. At the time of writing, Bitcoin is trading around $98,400.

A Cautious Market?

Despite the price increase, Glassnode notes that the Bitcoin perpetual futures market remains relatively calm. Funding rates are only slightly above 0.01%, far below the March 2024 peak of ~0.07%. This suggests there’s still room for Bitcoin’s price to grow, but also that the market isn’t completely swept up in the hype. Many traders are proceeding cautiously.