It’s not a question of if Bitcoin will hit $100,000, but when. The crypto world is buzzing about it. Reaching six figures would be huge for crypto, but it also means trouble for some traders who bet against Bitcoin (short sellers). Let’s look at what might happen next.

What’s Next After the $100K Milestone?

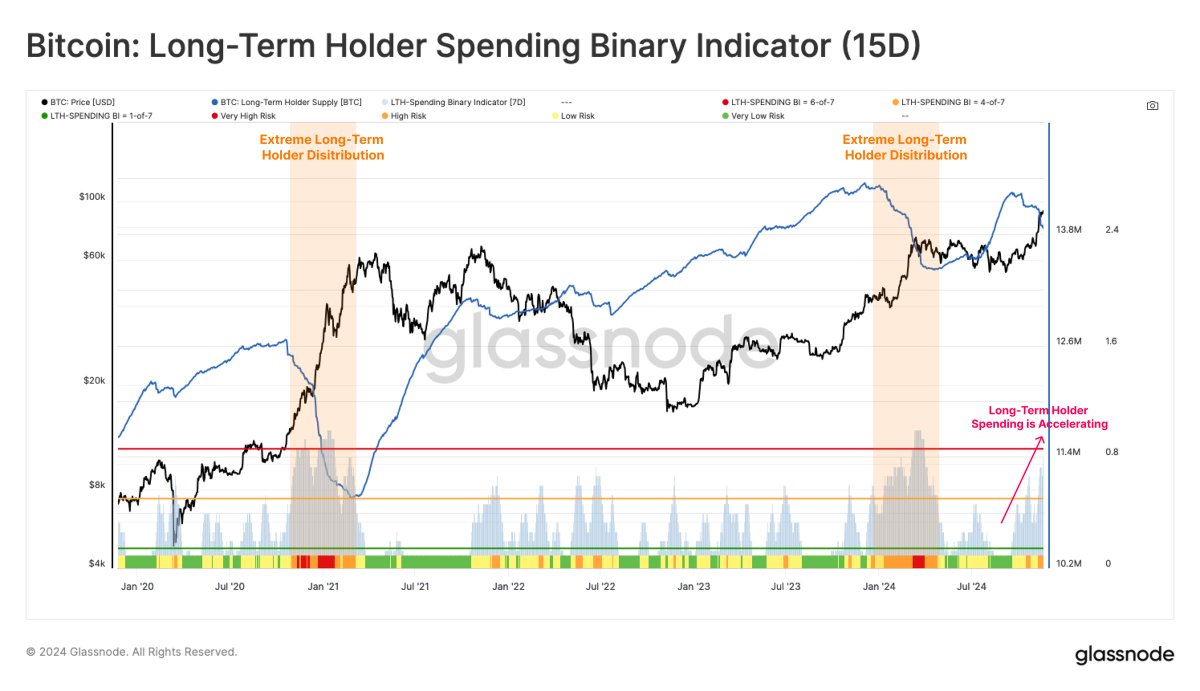

According to Glassnode, a blockchain analytics firm, Bitcoin’s price might lose steam after hitting $100,000. Why? Long-term holders (LTHs) – those who’ve held Bitcoin for a while – are starting to cash in.

Long-Term Holders Cashing Out

Glassnode’s data shows LTHs are selling more and more. For 11 out of the last 15 days, their Bitcoin holdings have decreased. While institutional investors, particularly through ETFs, have absorbed most of this selling, recently the selling pressure from LTHs is exceeding the buying pressure from ETFs. This happened earlier in February 2024, too, leading to price volatility and consolidation. If this trend continues, we could see more price swings or a period of sideways movement (consolidation).

The $1.89 Billion Liquidation Trigger

Analyst Ali Martinez pointed out that a whopping $1.89 billion worth of Bitcoin positions are at risk of liquidation if the price hits $100,625. That’s a lot of money! With Bitcoin currently hovering around $99,424, this could happen soon. The price has already seen a significant 10% jump in the last week.