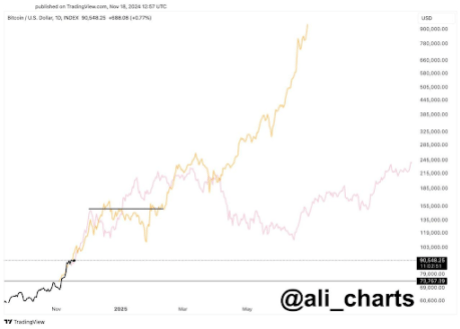

Analyst Ali Martinez predicts a rollercoaster for Bitcoin. He thinks it could skyrocket to $138,000, only to plummet by 30% afterward.

History Repeating Itself?

Martinez bases his prediction on past Bitcoin bull runs. In 2017, Bitcoin soared 156% beyond its previous high before a 39% correction. Similarly, in 2020, it rallied 124% before a 32% drop. If this pattern continues, a run to $138,000 followed by a significant correction seems plausible.

The Road to $138,000 (and Beyond?)

Bitcoin’s recent price surge, fueled partly by the Trump election news, has cooled off. Martinez believes a sustained daily close above $91,900 is crucial. This would invalidate the bearish outlook and potentially propel Bitcoin to $100,680, paving the way for the $138,000 target. He even later raised his target to $150,000, suggesting the breakout could happen very soon before the correction.

A Warning Sign: The Greed Index

Martinez points to the current peak in the “greed index” as a potential warning sign. High greed often indicates overleveraged investors, setting the stage for a market correction.

Another Analyst’s Take: Doubling in Three Weeks?

Analyst Kevin Capital offers a different perspective. He predicts Bitcoin could double its price within the next three weeks, based on its performance in previous cycles after breaking its all-time high. He notes that Bitcoin is currently around 45-50% away from doubling from its previous high of $73,000 and is in the third week of this potential price discovery phase. However, he acknowledges that this cycle is unique, as Bitcoin hit a new ATH before the halving event.

Current Bitcoin Price

At the time of writing, Bitcoin is trading around $91,900.