Bitcoin’s price has skyrocketed recently, hitting a new all-time high. But is this party about to end? One analyst thinks so.

Profit Taking Warning Signs

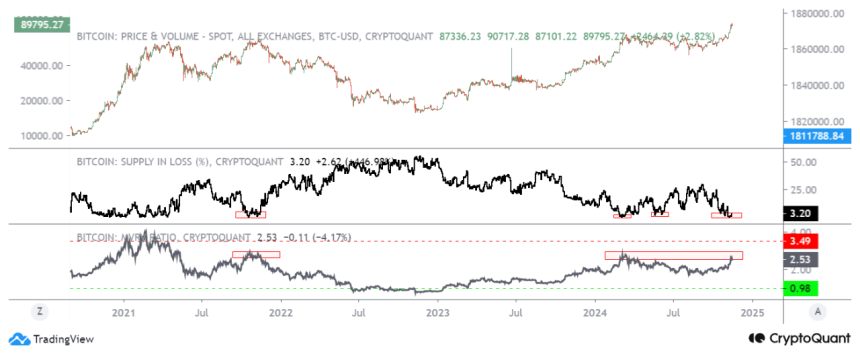

Crypto analyst Amr Taha is raising some red flags. He’s looking at something called the Bitcoin MVRV ratio. This ratio basically tells us if Bitcoin is overvalued or undervalued. A high MVRV suggests a lot of people are holding Bitcoin at a profit and might be ready to cash out.

Right now, the MVRV is at 2.64. Historically, when it hits this level (around 2.5 to 3.5), Bitcoin tends to see some serious price drops. This is because many people who bought low are now selling high to lock in their profits.

While a MVRV of 2.64 is a warning sign, it’s not a guaranteed crash. It could still go higher, maybe even to 4, before a major top is formed. Taha suggests keeping an eye on it:

- MVRV rising towards 3: Could mean more gains are coming.

- MVRV dropping to 1.5-2: Suggests a price peak is near.

Another Red Flag: Short-Term Holders

Taha also points to another concerning factor: short-term Bitcoin holders (STHs) now have a realized market cap of over $30 billion. This is a level that has historically been followed by significant price corrections. This adds to the concern that a price drop is likely.

The Bottom Line

Bitcoin is currently trading around $91,738. While it’s up recently, trading volume is down. The high MVRV ratio and the large realized market cap held by STHs are both warning signs that a price correction could be on the horizon. However, it’s not a definite prediction; the situation needs continued monitoring.