Bitcoin’s been on a tear lately, hitting record highs in just a few days. While Trump’s election win might have started the party, Bitcoin’s rise seems unstoppable. But will it keep going? Some think the rally’s over, but CryptoQuant, a big name in blockchain analytics, says Bitcoin still has plenty of room to grow.

Four Reasons for a $100,000 Bitcoin

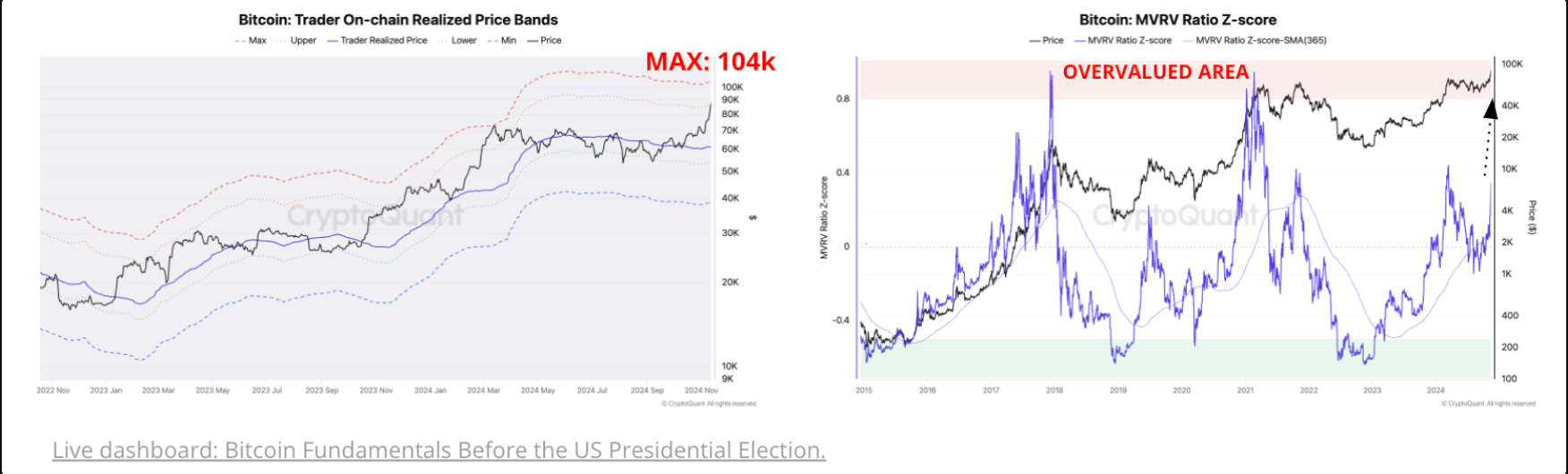

CryptoQuant’s latest report argues that Bitcoin isn’t overvalued, even with its recent surge. They see a path to that coveted $100,000 mark based on these factors:

-

MVRV Still Low: The Market Value to Realized Value (MVRV) metric shows Bitcoin isn’t in overbought territory. This suggests the rally isn’t overheating and higher prices are possible.

-

Trader On-chain Realized Max Band: This indicator points to $100,000 as the next price target. The last time it was this high (March 2024), Bitcoin broke $70,000 for the first time.

-

Increased Demand:

Investor demand, especially in the US, has picked up since the election, with Coinbase showing positive signs.

Investor demand, especially in the US, has picked up since the election, with Coinbase showing positive signs. -

Growing Liquidity: More and more stablecoins (like USDT) are flowing into exchanges. Over $3.2 billion in USDT has entered exchanges since the US election, fueling the potential for continued growth.

A Word of Caution

CryptoQuant isn’t saying it’s a sure thing. They warn that some selling could happen soon. While Bitcoin miners have started selling some of their holdings, it’s still relatively small. But this could change quickly.