Venture capitalist Chamath Palihapitiya is sounding the alarm about the US economy. He claims that while official reports paint a rosy picture, the reality is much bleaker.

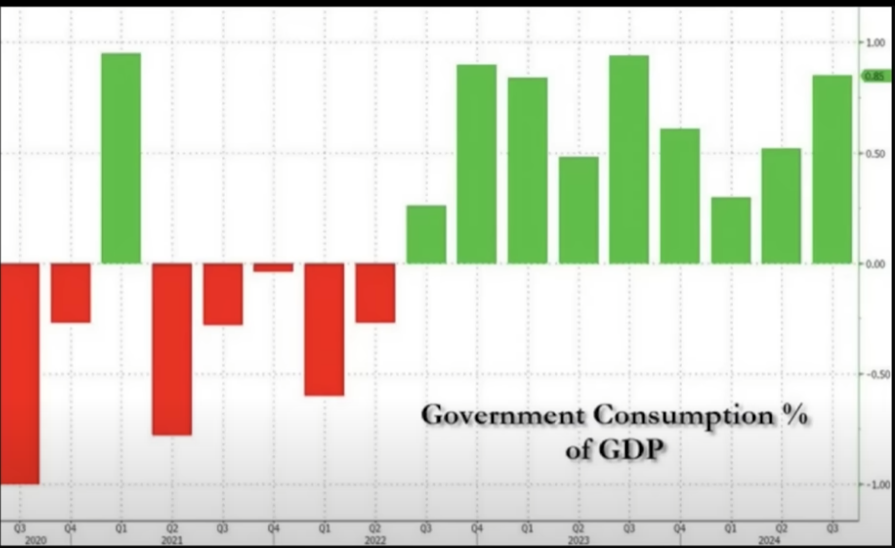

Government Spending is Masking a Deeper Problem

Palihapitiya argues that government spending is artificially propping up the economy. He points out that if you remove government spending from the equation, the US economy has actually been stagnant for the past few years.

“Private businesses are struggling,” he says. “They’re seeing softening demand, but the official numbers make it look like everything is fine. It’s like they’re hiding the truth.”

A Recipe for Disaster?

Palihapitiya warns that this reliance on government spending is unsustainable. He believes that the private sector will eventually realize that the economy is being distorted by government intervention.

“It’s like a house of cards,” he says. “The markets can’t function properly when the government is artificially inflating the economy. Eventually, the whole thing will collapse.”

He predicts that investors will eventually lose confidence and pull their money out of the market, leading to a major economic downturn.

The Bottom Line

Palihapitiya’s comments are a stark warning about the state of the US economy. He believes that the government’s reliance on spending is creating a false sense of security and setting the stage for a potential economic crisis.