The Hype Around Spot Bitcoin ETFs

Spot Bitcoin ETFs have been making headlines recently, attracting over $5 billion in investments in just three weeks. This coincides with a significant Bitcoin price rally of over 23%. But is this all just hype?

Analyst Claims ETFs Don’t Bring New Money

Jim Bianco, a macro investment researcher, argues that these ETFs aren’t bringing in new money to the Bitcoin market. He points out that Bitcoin hasn’t surpassed its all-time high despite the ETFs attracting over $12 billion in investments.

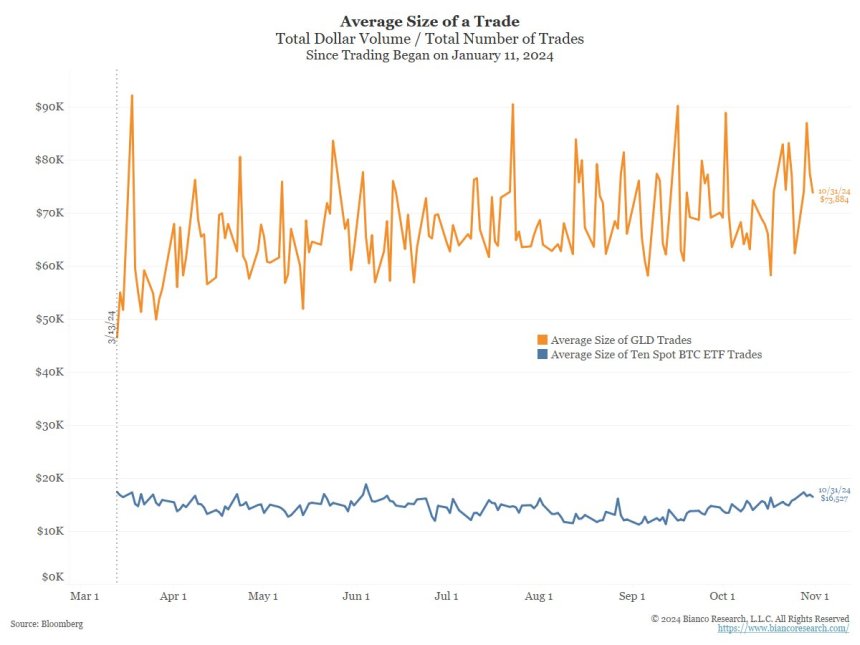

Bianco believes that the money flowing into these ETFs is coming from existing Bitcoin holders, who are simply shifting their investments from wallets or exchanges. He cites a report from Coinbase that shows a decline in retail Bitcoin traders, and the average Spot Bitcoin ETF trade size is significantly smaller than the average gold ETF trade, suggesting institutional investors are driving the market.

A Counterargument from Bloomberg

Eric Balchunas, a Bloomberg ETF analyst, disagrees with Bianco’s assessment. He argues that Spot Bitcoin ETFs have played a crucial role in driving Bitcoin’s price up from $35,000 in January to its current level. He highlights the ETFs’ low cost, high liquidity, and association with established brands as key factors in their success.

The Debate Continues

The debate over the impact of Spot Bitcoin ETFs on the Bitcoin market continues. While some argue that they are simply recycling existing investments, others believe they are a powerful force driving the market forward. Only time will tell which side is right.