Bitcoin has been on a tear lately, breaking past $71,000 and showing signs of a strong comeback.

Demand is Back

A key indicator called “Apparent Demand” has been surging, suggesting that investors are once again eager to buy Bitcoin. This metric tracks the difference between new Bitcoin being created (through mining) and the amount of Bitcoin that’s being held long-term.

When Apparent Demand is high, it means more people are buying Bitcoin than selling it, which can push prices up.

Here’s what’s interesting: Apparent Demand has reached the same level it was at in February of this year. Back then, Bitcoin went on a wild ride to a new all-time high. Could we be seeing a repeat of that?

Apparent Demand has reached the same level it was at in February of this year. Back then, Bitcoin went on a wild ride to a new all-time high. Could we be seeing a repeat of that?

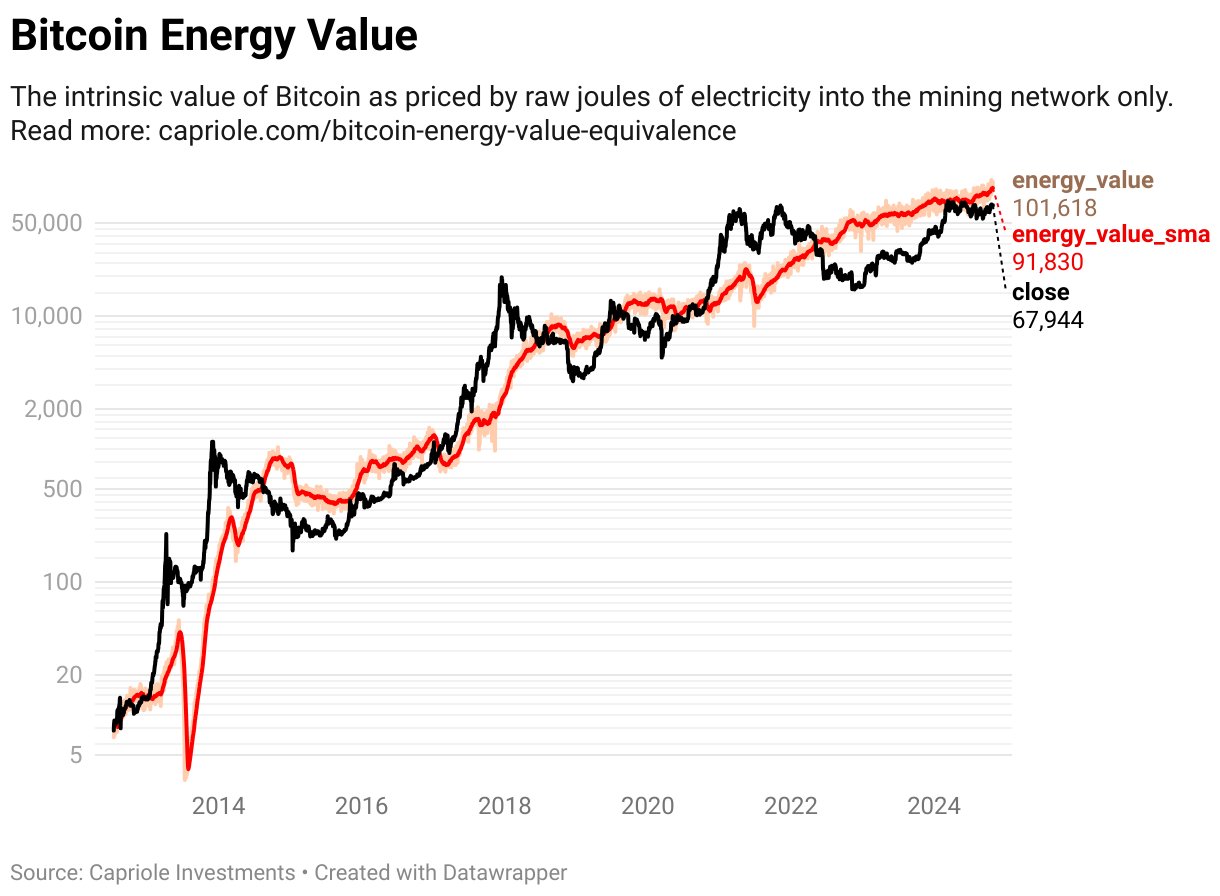

Energy Value Hits a Milestone

Another indicator, the “Bitcoin Energy Value,” has just crossed $100,000 for the first time ever. This metric measures the value of Bitcoin based on the amount of energy used to mine it.

The fact that the Energy Value is rising alongside the price of Bitcoin suggests that the market is confident in the long-term value of the cryptocurrency.

Bitcoin is on a Roll

Bitcoin is currently trading at around $72,400, up almost 8% in the past week. With demand surging and key indicators hitting new highs, it’s looking like Bitcoin is ready to make a serious run for the top.