Bitcoin’s grip on the crypto market is loosening, with its dominance falling below 50%. This could be a sign of trouble for the king of crypto, especially as retail investors are jumping back into the market.

Retail Returns, Bitcoin Slips

When retail investors get involved, they often prefer altcoins over Bitcoin, hoping for bigger gains. This is exactly what happened in the 2021 bull market, where new altcoins stole the spotlight and Bitcoin’s dominance plummeted.

This time around, the rise of NFTs and DeFi is making altcoins even more appealing. Investors are starting to see the value in networks like Ethereum, which offer more flexibility than Bitcoin.

A Shift in the Crypto Landscape

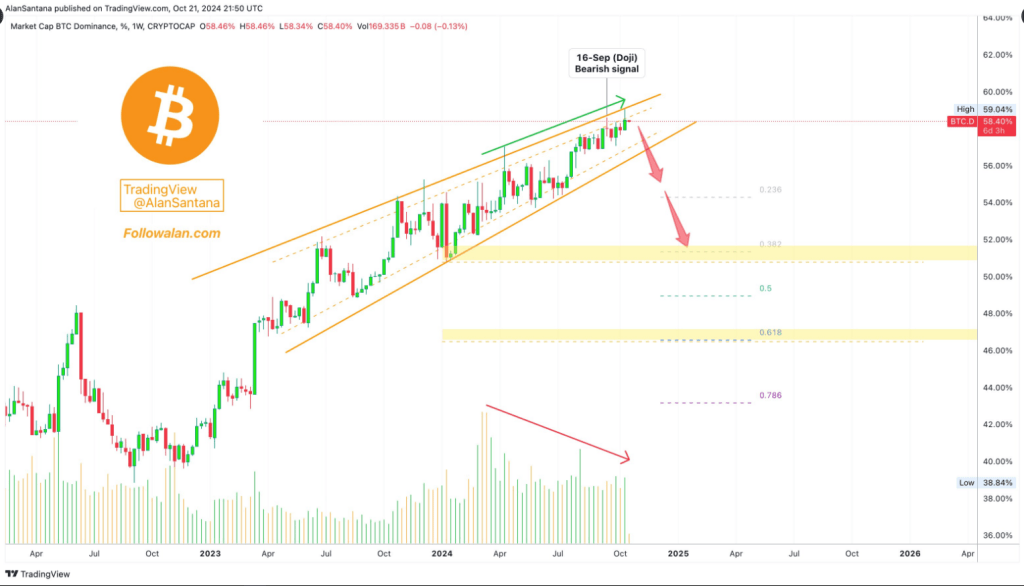

The decline in Bitcoin’s dominance could be a sign of a broader shift in the crypto market. While Bitcoin was once the clear leader, investors are now looking for more diverse and innovative options.

A Volatile Future?

This shift could lead to more volatility in the crypto market. As investors chase higher returns in altcoins, prices of both Bitcoin and altcoins could swing wildly.

What Does It Mean for You?

If you’re a crypto investor, it’s important to be aware of these trends. Bitcoin’s dominance is a key indicator of market sentiment, and its decline could signal a more volatile future.

Keep an eye on the market and adjust your strategies accordingly.