Bitcoin recently went on a wild ride, surging from around $62,000 to a peak of $66,500 in just a couple of days. While it’s dipped a bit since then, it’s still hanging around $65,000. So what caused this sudden surge? Let’s break it down.

Short Squeeze and Election Hype

One big factor was a short squeeze, where traders who bet against Bitcoin were forced to buy back their positions, driving the price up. This happened at a particularly interesting time, just a few weeks before the US elections. Historically, Bitcoin has seen big rallies in the weeks leading up to US elections, and this year might be following the same pattern.

Strong Demand for Bitcoin

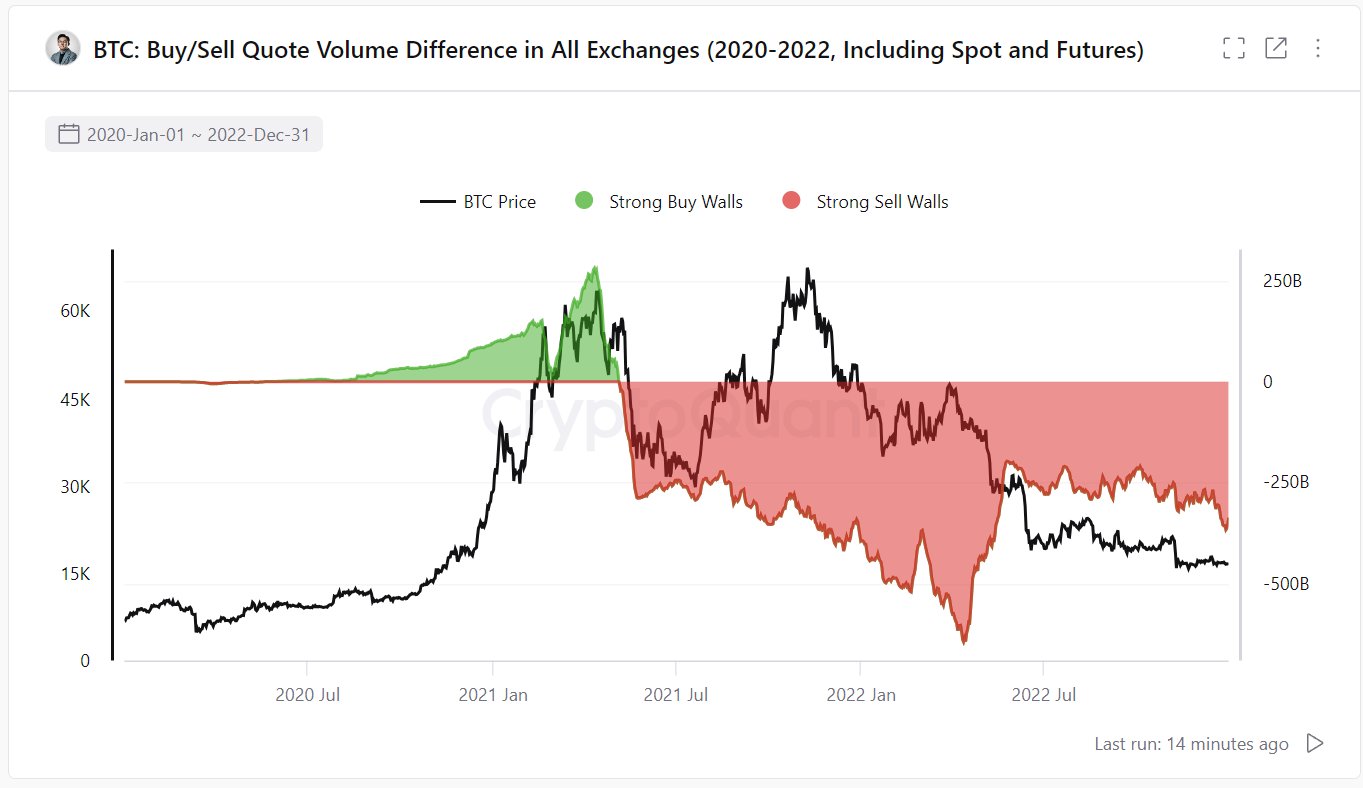

Another key factor was strong demand for Bitcoin in the spot market. This means people were actually buying Bitcoin, not just speculating on its price. This shift in sentiment is a good sign for Bitcoin’s future.

Big Money Flows into Bitcoin ETFs

Finally, there was a huge influx of money into Bitcoin Exchange Traded Funds (ETFs). These are funds that allow investors to buy Bitcoin without actually owning it directly. The amount of money flowing into these ETFs was massive, showing that institutional investors are increasingly interested in Bitcoin.

All these factors combined created a perfect storm for Bitcoin’s recent surge. It’s still early to say whether this rally will continue, but it’s clear that Bitcoin is gaining traction with both individual investors and big institutions.