Bitcoin’s Supply is Getting “Stuck”

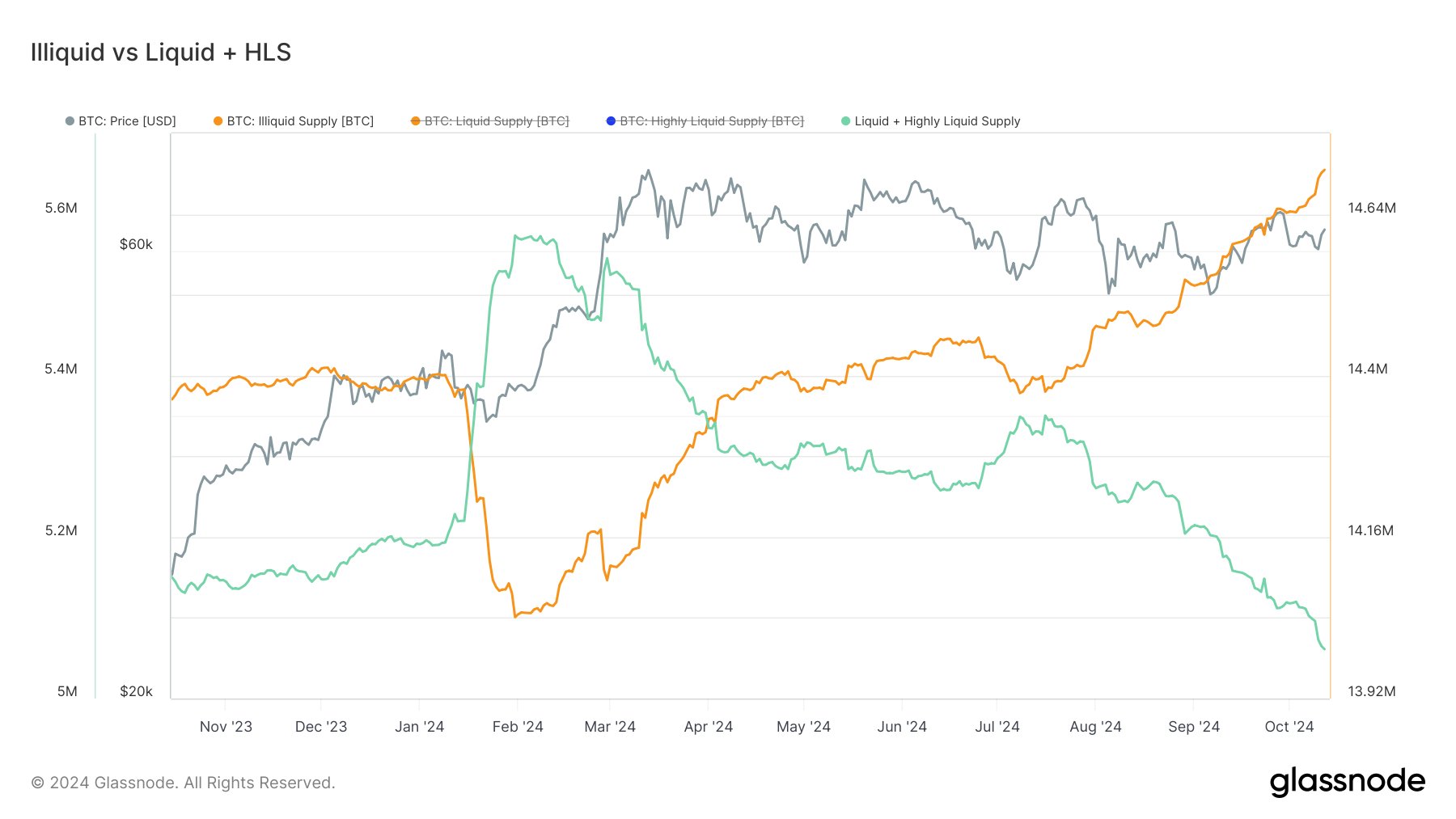

A recent trend in Bitcoin is causing a stir: more and more Bitcoin is being held by investors who aren’t selling. This is known as the “illiquid supply” and it’s reaching record levels.

What is Illiquid Supply?

Think of it like this: imagine you have a bunch of coins in your piggy bank. You’re not planning on spending them anytime soon, so they’re considered “illiquid.” In Bitcoin, this means coins held by investors who are holding onto them long-term and aren’t actively trading.

More Bitcoin is Getting Locked Up

According to analysts, the amount of Bitcoin considered “illiquid” has been steadily increasing since the beginning of the year. This means more and more investors are choosing to hold onto their Bitcoin rather than selling.

What Does This Mean for Bitcoin’s Price?

This trend could have a big impact on Bitcoin’s price. If less Bitcoin is available for trading, it could lead to higher prices as demand outpaces supply.

The Future of Bitcoin’s Supply

Analysts are watching this trend closely, as it could signal a shift in investor sentiment towards Bitcoin. With more and more Bitcoin being held by long-term investors, it could indicate a growing belief in Bitcoin’s future value.