Ethereum’s price is stuck in a narrow range, bouncing between $2,300 and $2,800. While some investors are optimistic about future price increases, uncertainty hangs in the air.

A Lifeline at $2,300?

Ethereum has taken a hit, dropping over 50% from its July peak and struggling to break through the $3,500 resistance. But there’s a glimmer of hope: analysts have noticed a large amount of Ethereum (over 52 million ETH) bought around the $2,300 level. This suggests that this price point could act as a strong support level.

If buyers manage to push the price up from here, it could signal a bullish trend. However, if sellers continue to dominate, Ethereum could fall below its Q3 2024 lows. The current sentiment is bearish, with over 65% of ETH holders expecting a short-term price struggle.

Is Buying Power Drying Up?

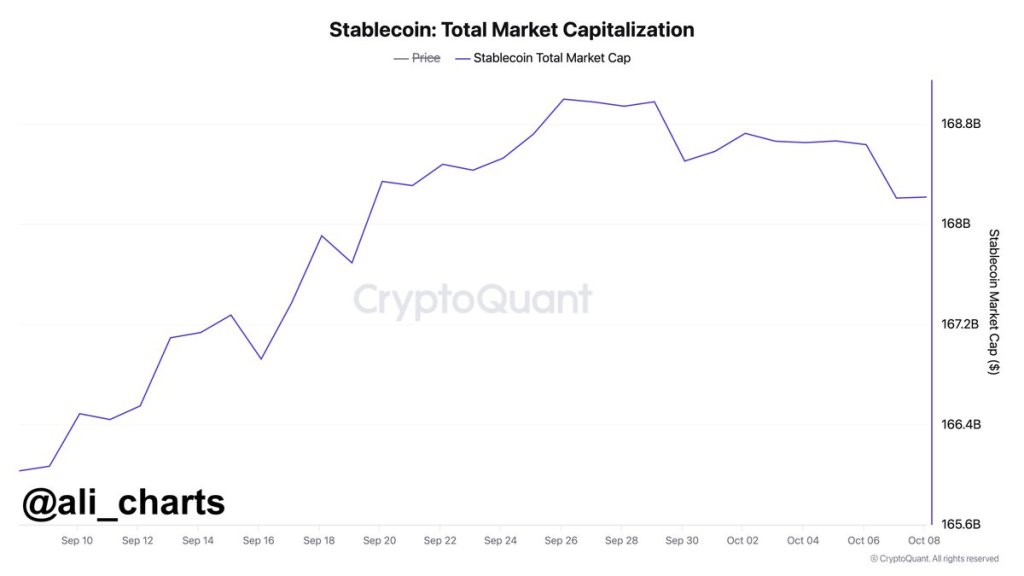

While some are hopeful, other market indicators point to potential weakness. The market capitalization of stablecoins like USDT and USDC has been declining in recent weeks. This could indicate a decrease in buying power.

Stablecoins typically flow to centralized exchanges when investors are eager to buy crypto assets. A decline in their market cap could suggest that investors are becoming more cautious and hesitant to commit. This could be a warning sign of a broader market correction.

Although there haven’t been significant inflows of ETH to centralized exchanges, a large amount of ETH is being staked. Over 34 million ETH is currently locked, earning holders a 3.3% annual percentage yield.

Ultimately, how Ethereum performs at the $2,300 support level will determine its short-term trajectory. A strong surge above $2,800 could reignite bullish sentiment and attract more buyers. However, if the price continues to fall, it could signal a more extended bearish period.