Bitcoin had a rough start to October, dipping below $60,000. This was likely due to tensions in the Middle East. However, the coin has bounced back, trading above $62,000.

Liquidations: A Sign of Hope?

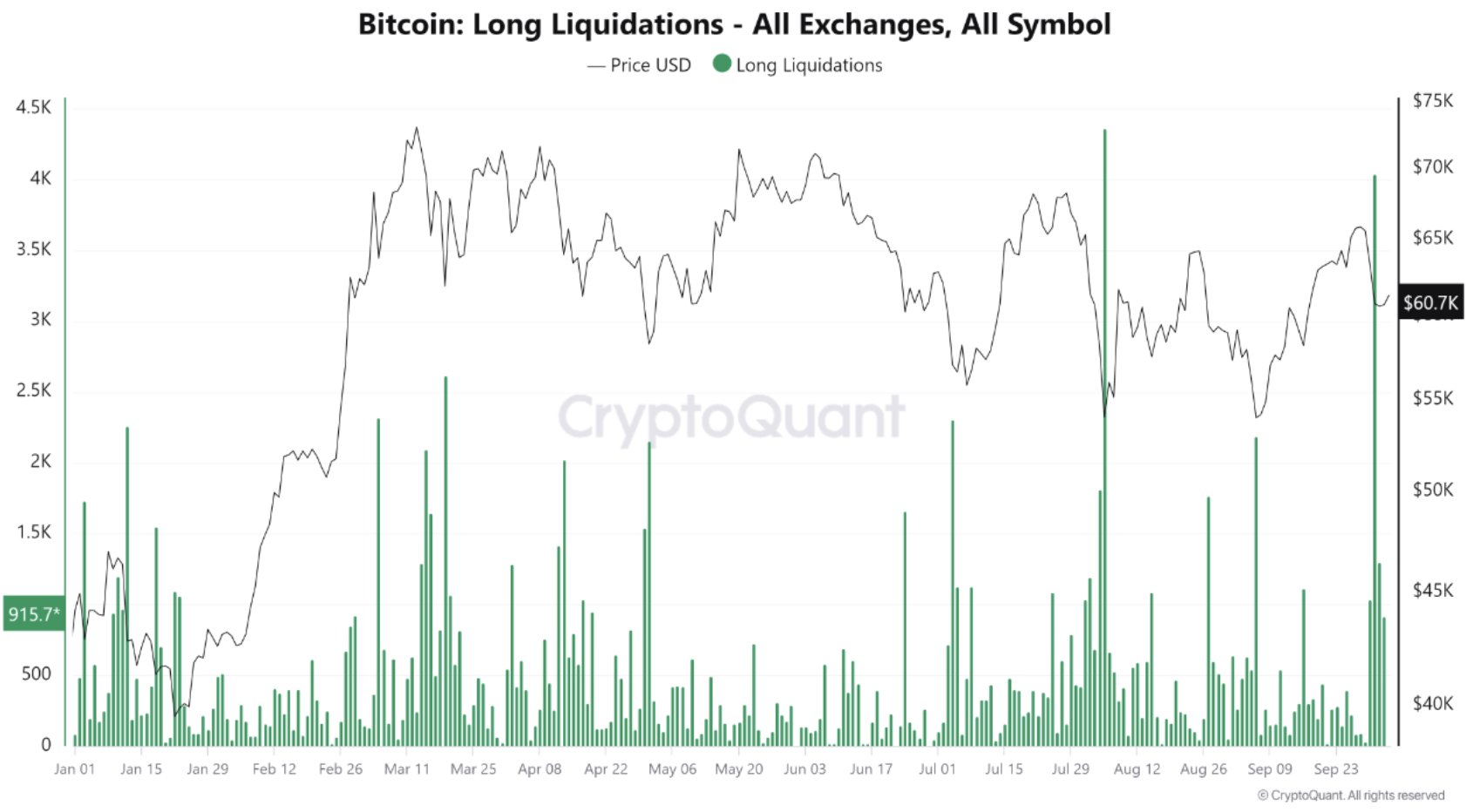

Analysts are pointing to a recent wave of liquidations in the Bitcoin futures market as a positive sign. Liquidations happen when traders who bet on the price going up are forced to sell their positions due to losses. This selling pressure can drive prices down, but it also signals a potential shift in market sentiment.

In this case, the liquidations have actually reduced the selling pressure on Bitcoin, suggesting that the worst of the dip might be over.

Bitcoin’s Potential Comeback

While Bitcoin is still down slightly for the week, the recent rebound and the reduced selling pressure suggest that it could be heading back towards $65,000.

However, for Bitcoin to make a full recovery, investors need to start buying again.

Overall, the recent dip in Bitcoin’s price might be a good buying opportunity for those who believe in the long-term potential of the cryptocurrency.