Ethereum is currently taking a dip, mirroring the broader crypto market downturn. Bitcoin, Ethereum, and other top cryptocurrencies are all experiencing losses, pushing the total market cap down to $2.17 trillion. If the bears continue their push, we could see even more losses, wiping out the gains from September.

Is $2,350 Ethereum’s Lifeline?

Over the past week, Ethereum has dropped by 10%, falling below its previous support level of $2,400, which is now acting as resistance. While this might seem discouraging, some traders are actually buying Ethereum at these lower prices.

Data from IntoTheBlock shows that 1.89 million Ethereum addresses bought 52 million ETH at prices between $2,311 and $2,383. This means that a significant number of buyers are finding value around $2,350, making it a crucial support level to watch.

To break below this level, sellers would need to put in a lot of effort, potentially pushing Ethereum down to $2,100 and even the August lows. Interestingly, $2,350 aligns with the 61.8% and 78.6% Fibonacci retracement levels, which are often seen as support areas for crypto prices.

What’s Next for Ethereum?

Crypto prices, including Ethereum, often find support around Fibonacci retracement zones. How Ethereum performs between $2,100 and $2,350 will likely determine the medium to long-term trend.

A positive scenario: A rebound around this support level could give Ethereum a significant boost, potentially pushing it back above $2,800 and even towards $3,500.

A negative scenario: A sharp drop below the August and September lows could trigger panic selling, sending Ethereum down below $2,100 and even $2,000, potentially reaching as low as $1,800. This would confirm the losses seen in early August.

The Selling Pressure Continues

Right now, sellers seem to have the upper hand. Centralized exchanges have been seeing large outflows, indicating that traders are moving their funds out of exchanges, potentially to sell.

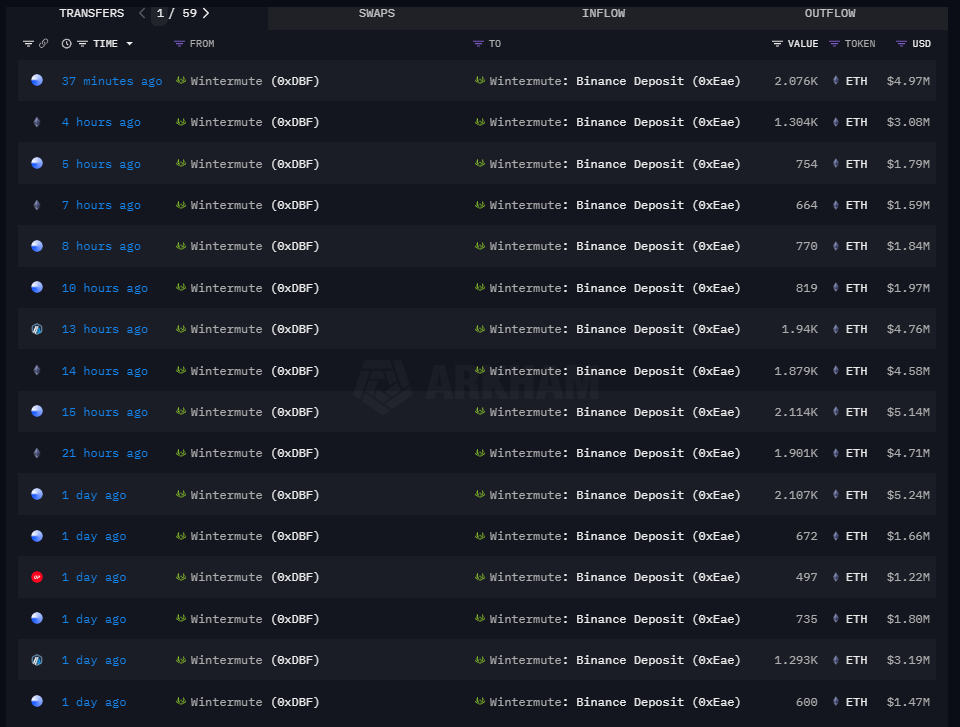

Recently, a crypto market maker called Wintermute moved 14,221 ETH to Binance, suggesting they might be preparing to sell. Back in August, Wintermute and other market makers like Jump Capital sold over 130,000 ETH, contributing to the price drop.

Overall, Ethereum is facing a challenging period. While the $2,350 level offers potential support, the selling pressure remains strong. The next few days will be crucial in determining whether Ethereum can find its footing or continue its downward trajectory.