A popular crypto analyst, Dan Gambardello, believes that Bitcoin might be nearing the end of its recent dip. He’s looking at some key indicators to support his claim.

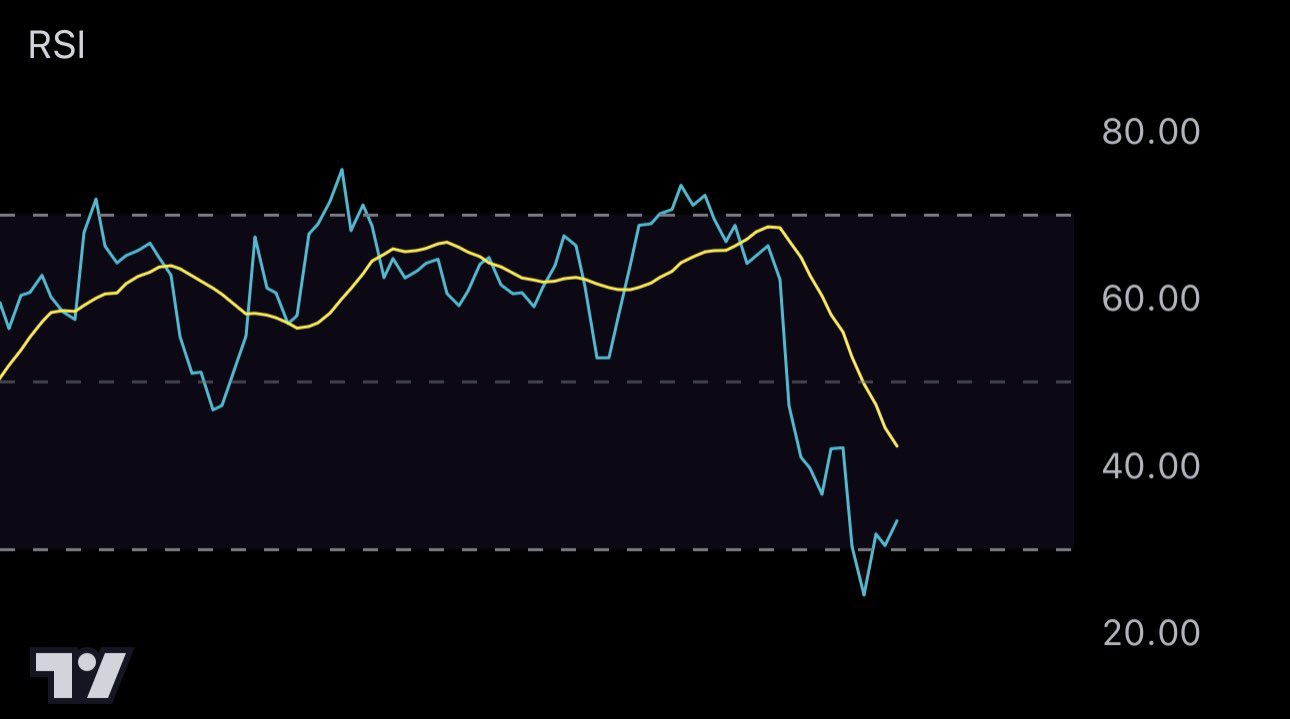

Oversold RSI Points to a Bounce

Gambardello is focusing on the 6-hour Relative Strength Index (RSI), a measure of how fast and how much the price of Bitcoin is changing. This indicator has hit “oversold” levels, which historically suggests a potential end to the current dip and a possible bounce back.

He’s also looking at the daily chart, where Bitcoin is currently testing the 50-day moving average. This level often acts as a barometer for short-term market sentiment.

October’s Historical Pattern

Gambardello draws parallels to Bitcoin’s behavior in previous Octobers, noting a pattern of initial dips followed by strong recoveries by the end of the month. He believes this year could follow a similar trend, suggesting a potential pump in the coming weeks.

Potential Support Levels

Gambardello also points to Bitcoin’s lower trend line, a level of support that has held for the past six months. He thinks that if Bitcoin touches this trend line again, it could act as a strong support level, marking the final dip before a sustained upward trend.

However, he acknowledges that a final touch of the trend line could potentially bring Bitcoin’s price down to $50,000. But he believes this is less likely because the 6-hour RSI is already oversold and Bitcoin is currently bouncing off the 50-day moving average.

Halving Year Trend

Finally, Gambardello emphasizes that this is a halving year, a period when the rate at which new Bitcoins are created is halved. He points out that in 2016 and 2020, halving years were followed by bull markets, suggesting that the current year could follow a similar trajectory.

While Bitcoin is currently trading around $60,899, Gambardello’s analysis suggests that this might be the last major dip before a potential upward surge. However, it’s important to remember that the cryptocurrency market is highly volatile, and any predictions should be taken with a grain of salt.